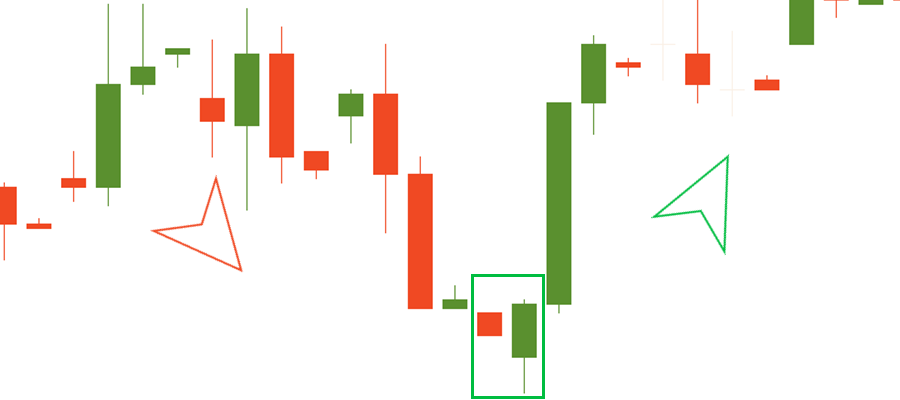

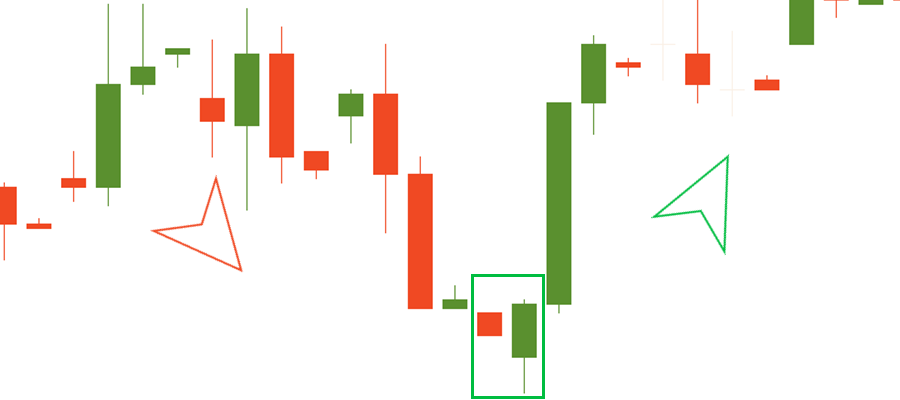

Rules for a long entry

1. Wait for a formation of the Bullish Engulfing pattern. This is the reversal pattern that forms at the end of the downtrend. It consists of a small red candlestick and a large green candlestick that engulfs the red one. The shadows of the small candlestick are short.

2. The candlestick pattern must be confirmed by the RSI indicator moving below the 40 level.

3. Open your position at the next candlestick after the pattern is confirmed.

4. You must close the short position when the RSI indicator crosses the 70 level to the upside.

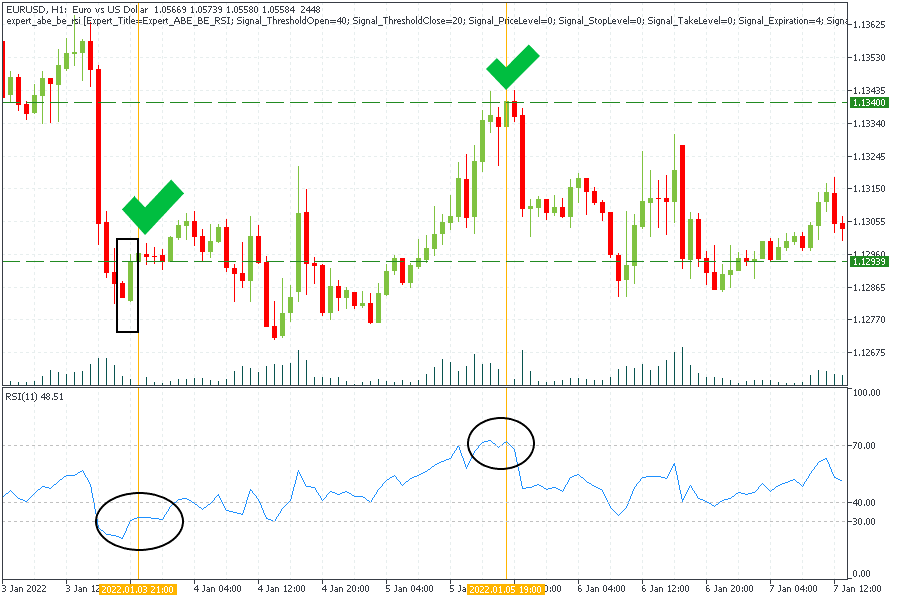

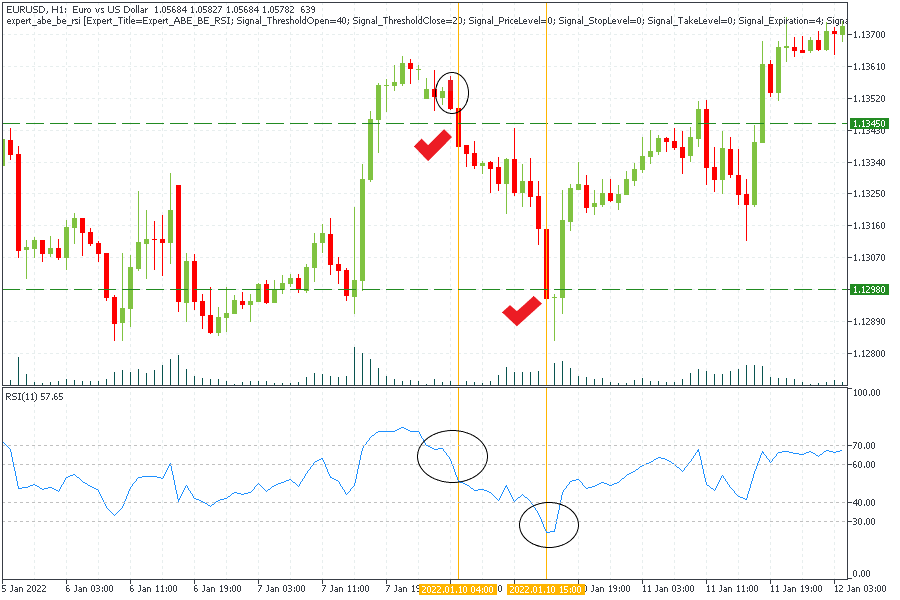

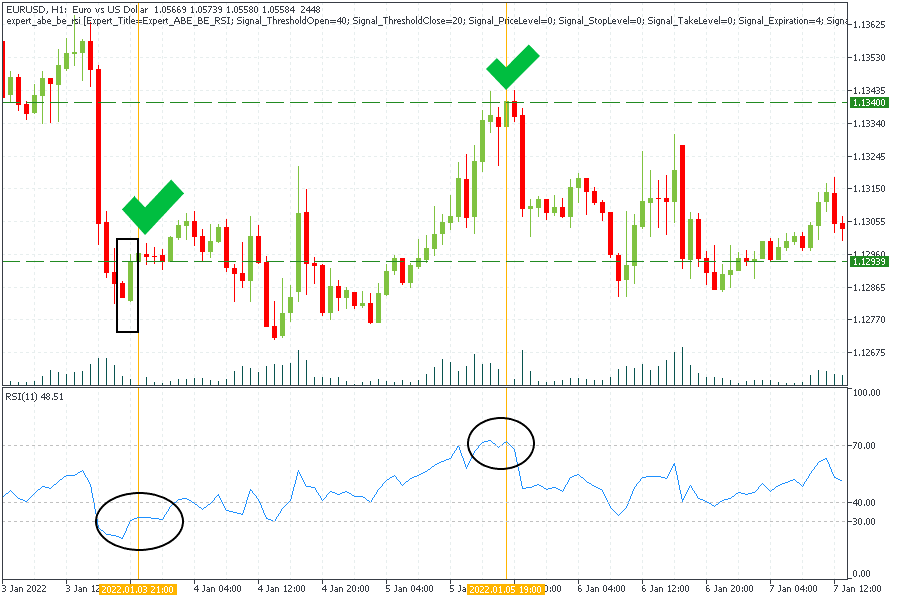

On the picture above you can see an example of this strategy on the H1 timeframe of the EURUSD chart.

After the price formed a pattern known as the Bullish engulfing, we checked RSI and it was moving below the 40 level. We opened a long trade at the opening price of the next bullish candlestick after the pattern at 1.12939. We closed the trade when RSI crossed the 70 level at 1.1340. We earned 461 points.

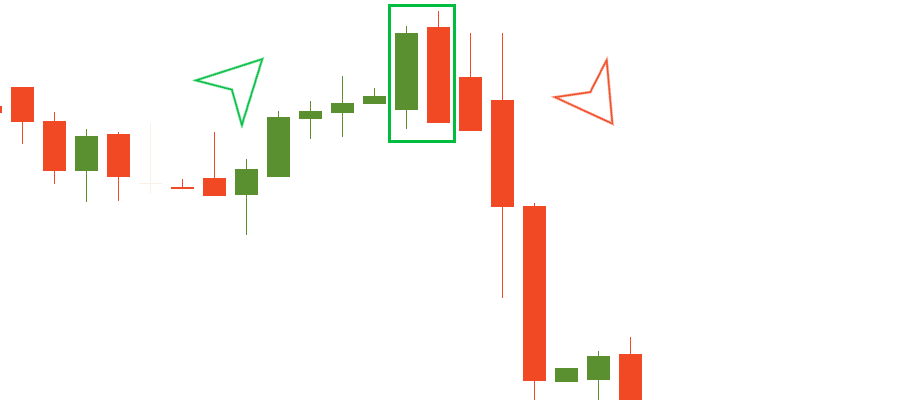

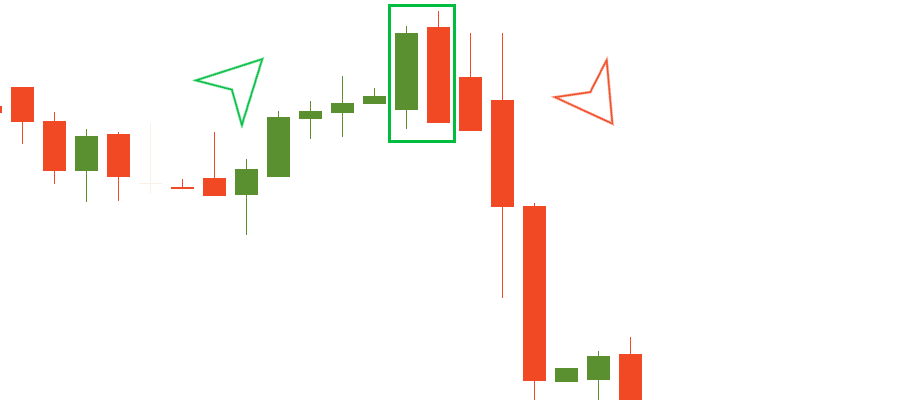

Rules for a short entry

1. Wait for a formation of the Bearish Engulfing pattern. It consists of a small green candlestick followed by the big red one.

2. The candlestick pattern must be confirmed by the RSI indicator that should be above the 60 line.

3. After the pattern is confirmed, you need to open a sell order at the next candlestick. It should be bearish.

4. You need to close the short position when the RSI indicator crosses the 30 level to the downside.

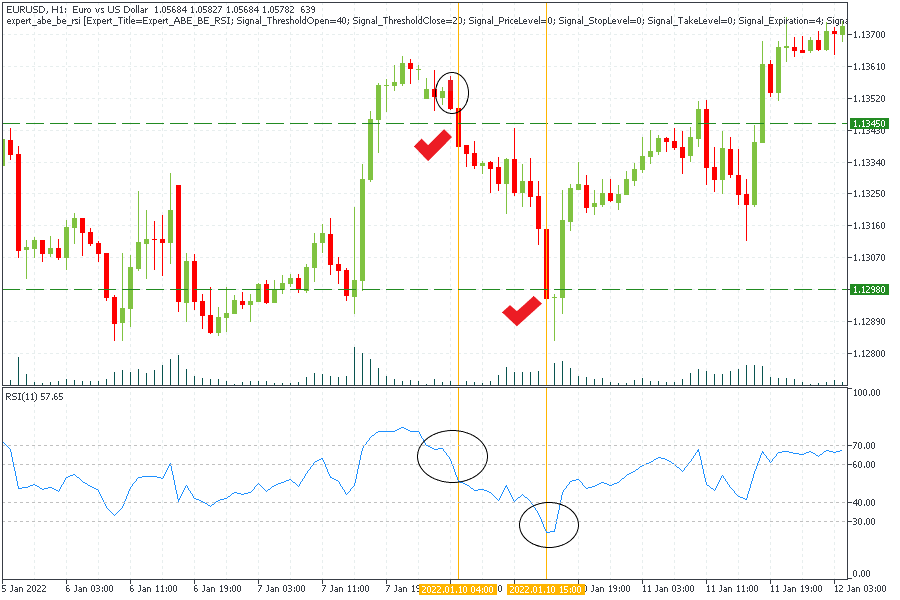

On the chart above, we opened a sell order after the Bearish Engulfing pattern was confirmed by RSI moving above the 60 level at 1.1345. After RSI entered the oversold zone, we closed our position at 1.1298. We earned 470 points.

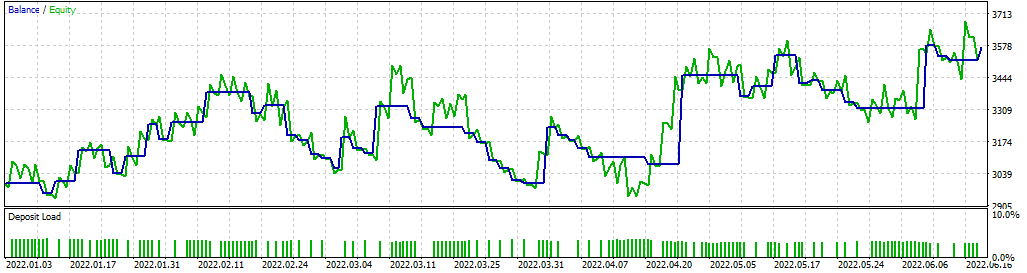

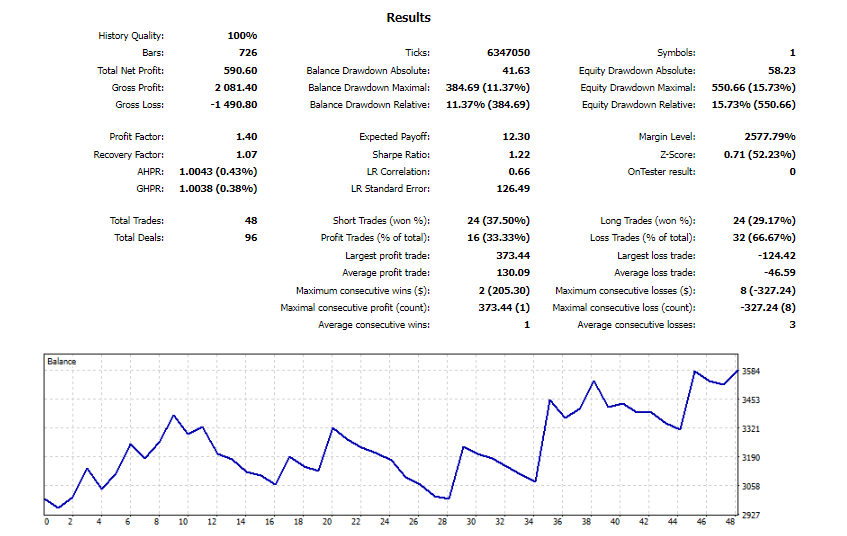

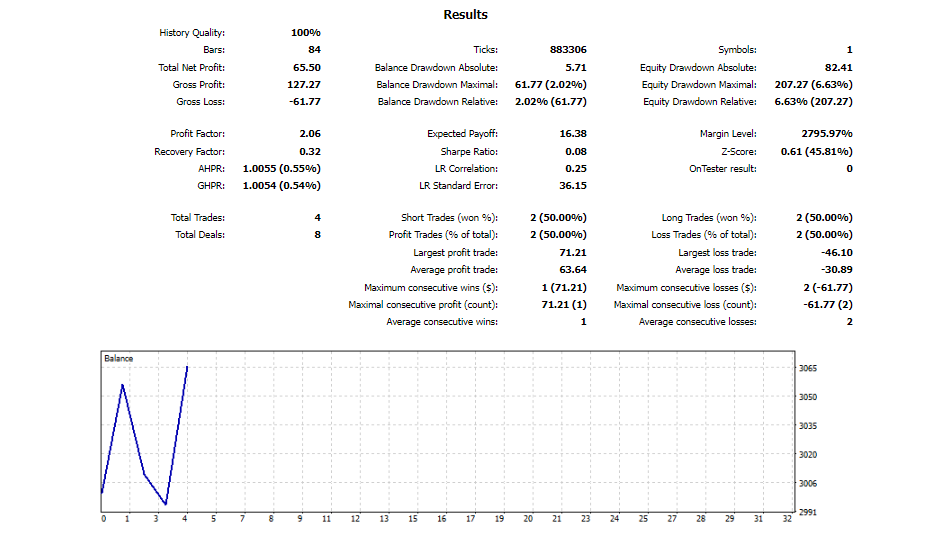

Backtesting a strategy