Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2019-12-10 • Updated

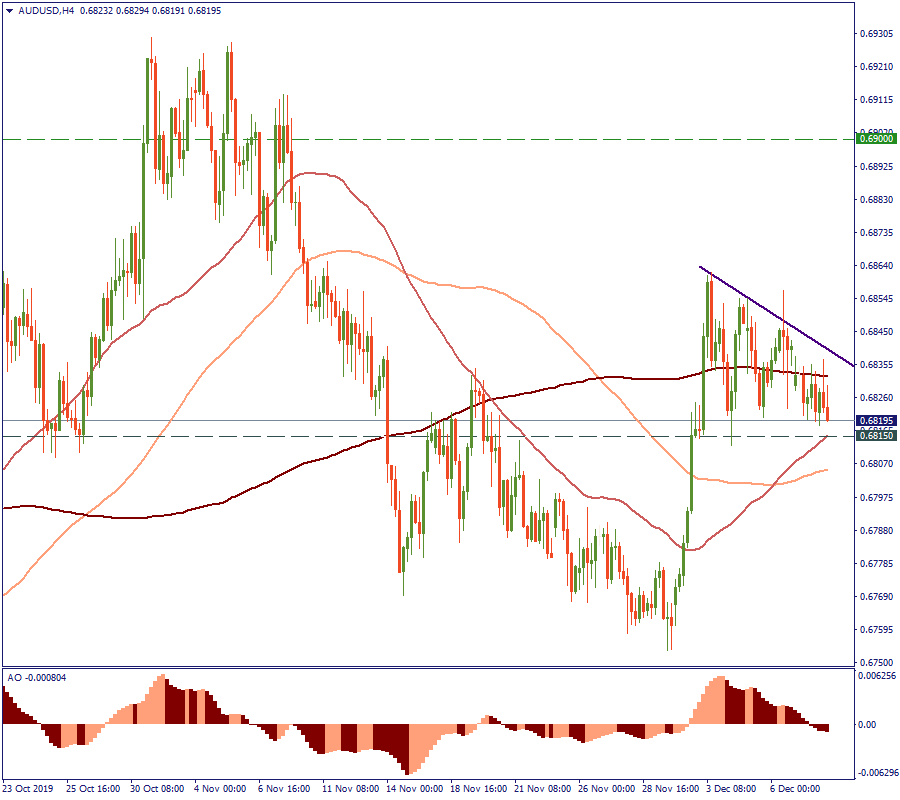

Since May 2018, when the price of AUD against the USD crossed the level of 0.7500, the long-term trend of the currency pair has been going downwards. The closer to the current moment, the more it has been confirming the decline: since June 2019, the 200-week, 100-week and 50-week Moving Averages are in the negative order, with 50-week MA being a resistance. Therefore, in the long-term, the price is likely to continue this direction unless there are strategic factors revealed that would change the setting. In any case, the price will have to struggle its way upwards in case the market reversal starts looming in the currency horizon. On the weekly chart, the resistance of 0.6900 would be a good checkpoint for that as it marks the previous high, and since the end of 2018, the price has never broken a previously reached distinctive high.

On the H4, AUD/USD is testing the support of the 50-period MA, which is at the level of 0.6815. In fact, it has been consolidating right above this level in a gradually decreasing magnitude of price action since the beginning of December. Now, if the price breaks this support on the way down, that will be a solid proof that the recent high area has completed forming and that the market is going to move down in a more decisive way. Awesome Oscillator has already crossed the zero line, which gives the same interpretation. Altogether, if there is no new incoming information altering the market setting, we are likely to observe another cascade down today and tomorrow.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!