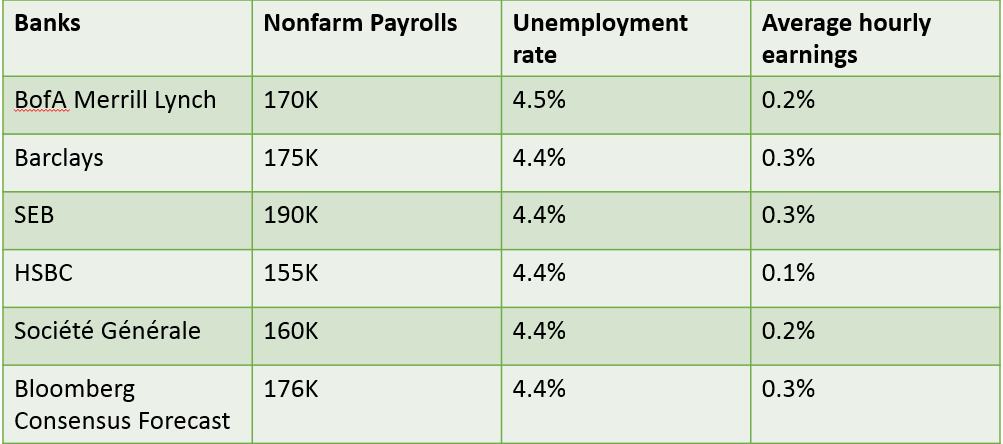

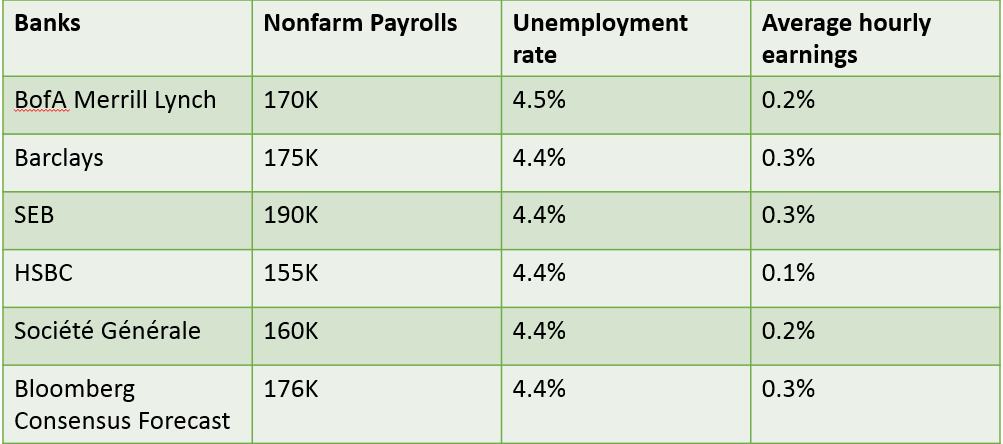

Analysts from major banks offer insights on their expectation from the today’s US labor market report which is due at 3:30 pm MT time. It will be critical for the Fed’s rate June decision as its monetary policy decisions are based on the changes in employment and inflation estimates. The headlines close to the forecasted data should produce a surprise effect across the trading board. There might be extreme fluctuation if the reading results in an extreme divergence from market’s expectations.

In general, we don’t expect great moves from the report; the employment has been extremely healthy in the past months (steadily growing) and it seems that it is not a great concern of the Fed’s officials anymore. Wages are becoming more important in the US labor market report as they have a strong correlation with inflation figures.

The upcoming release should bring around 181K new jobs which is a quite decent figure, sufficient for the market to think of rate hike at the Fed’s June meeting. The jobless rate is expected to remain unchanged at 4.4%, while monthly wages should disappoint markets with their soft print. If it is the case, the USD will be hurt.

Yesterday we release a strong ADP jobs report which has some correlation with official data. So, the US dollar rally appears to have already discounted an upbeat NFP print. it means that positive payrolls could even trigger ‘Sell the fact’ trading in the USD.