Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

2021-07-23 • Updated

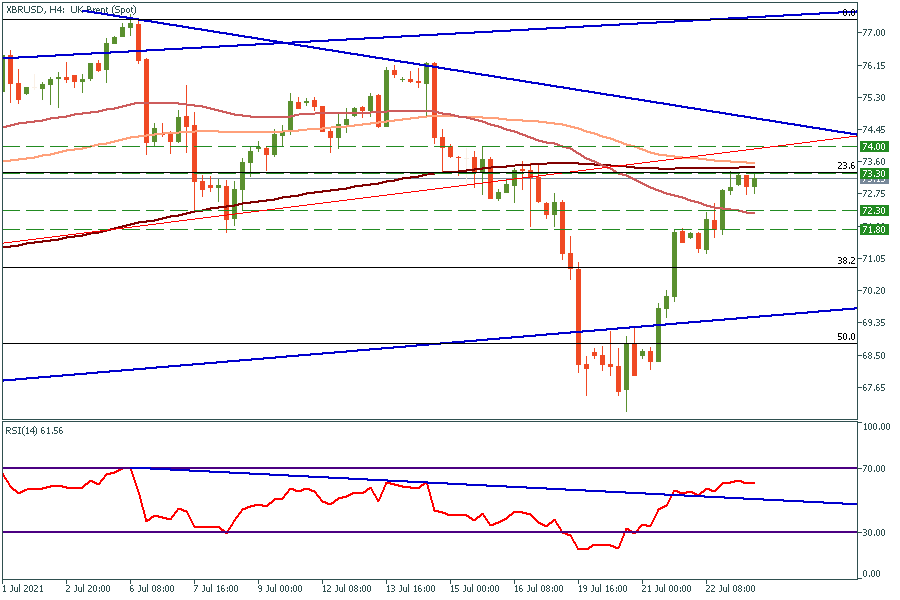

Brent returned to the rising channel on Wednesday by gaining 4% during the trading session. Investors are still looking towards risk assets despite data showing an unexpected rise in US oil inventories.

The fall was caused by the deal between members of the Organization of Petroleum Exporting Countries and allies, known as OPEC. The organization decided to raise supply by 400,000 barrels a day from August to December 2021. Investors were also scared about the new COVID Delta strain.

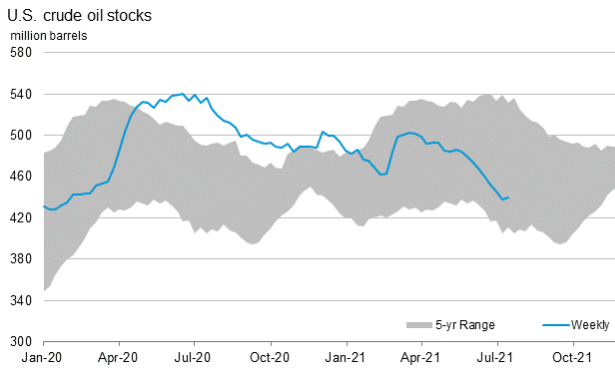

Oil price keeps growing, despite the fact that the US crude stockpiles went up for the first time since May. Investors are positive about the future as they are sure that the demand will exceed supply during 2021.

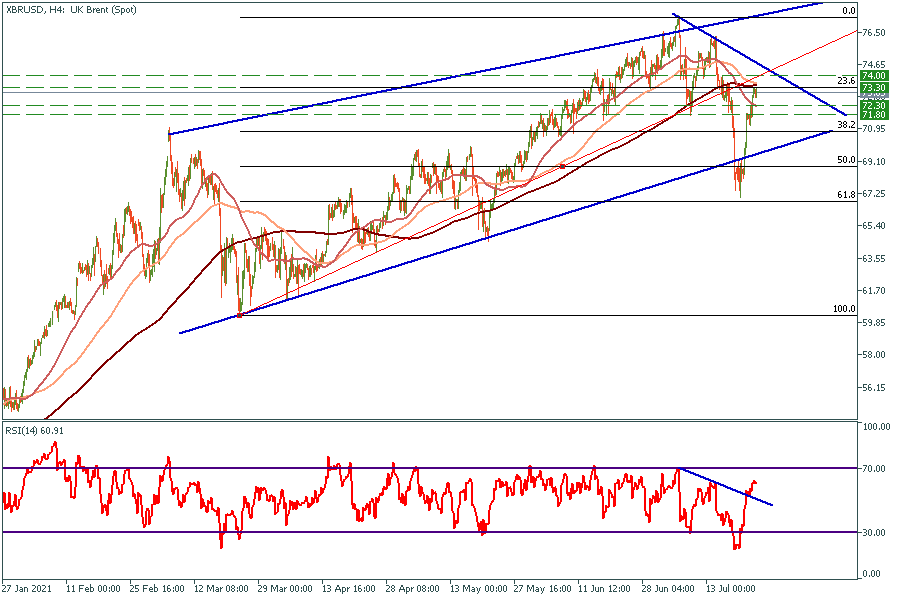

4H Chart

At the moment, the price is trying to break $73.3 resistance. It is an intersection of 100 and 200 period moving averages, also it is 23.6 Fibonacci level. On the RSI oscillator, the downtrend has been broken, which means bulls still have enough power to push Brent higher.

In the short term: If the price breaks $73.3 resistance, it will shortly reach the 74-74.5$ range. Otherwise, it might test the 50-period moving average at the level of 72.3 before the upcoming raise.

In the long-term: As the price breaks the $73.3 resistance level, it will head towards the top line of the rising channel with a target range between $77.3-$77.7.

Don't know how to trade Brent? Here are some simple steps.

Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

Why brothers? If you put an oil chart on the S&P500 chart, you will find out that these assets have a strong correlation…

Besides US Retail Sales data, Australian Unemployment Rate and New Zealand GDP this week will bring us Quadruple Witching – one of the four most important days of a year for futures and options!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!