Bullish view

EUR/USD has started the week with the right leg after falling down for almost two weeks. Most analysts link this risk appetite with eased restrictions all over the world. Also, the US data turned out better than analysts expected, what improved the market sentiment. In addition, last week several central banks gave more optimistic prospects for the economy which kept risk assets well bid. The US President Donald Trump claimed that he "can't shut down the economy again". Even if the second wave comes again, its impact will be less devastating and more localized.

Bearish view

Nevertheless, there are factors that weigh on the European single currency. First of all, fears of a second COVID-19 wave are competing with the encouraging economic data. The World Health Organization reported 183,000 new cases on Sunday which is the largest daily increase on record. Also, Friday's European Council meeting left a lot of uncertainty as EU members couldn’t make any agreement on the coronavirus recovery fund. Investors will wait for the July meeting for some hints.

What’s next?

It will be the big day for EUR on June 23 as traders will get French, German and EU Manufacturing PMI starting at 10:15 MT time. These indicators will help to understand the real state of the EU economy these days. If the data comes better than forecasts, EUR will rise. Also, take a look at the US Manufacturing PMI, that will be released later the same day at 16:45 MT time. It will add some volatility to EUR/USD, as well. According to Goldman Sachs, "Recent developments are a good reminder that “bad news” from the US can paradoxically lift the Dollar if it affects investor risk appetite or raises questions about the global economic outlook." Based on that, we can assume that the positive US data will push EUR up.

Check the economic calendar

Technical tips

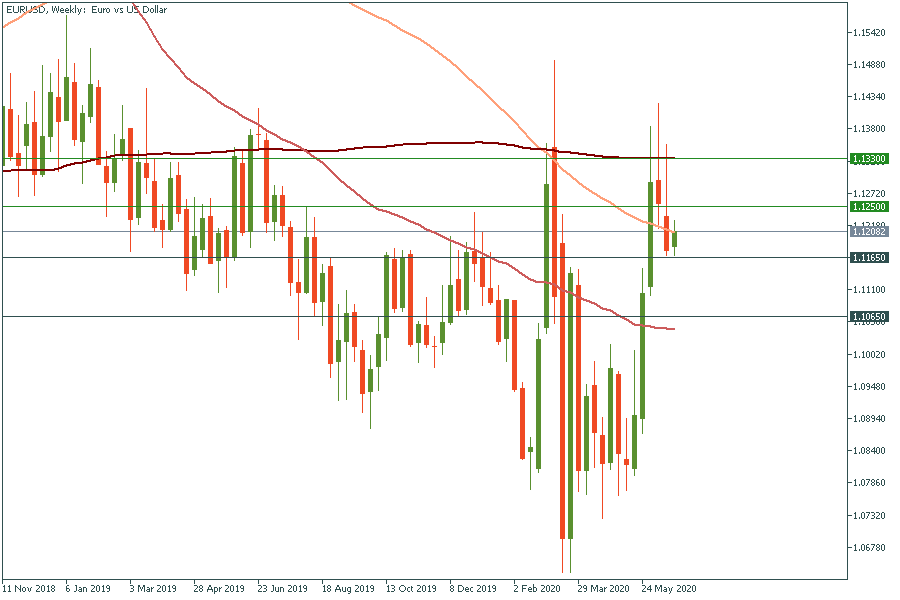

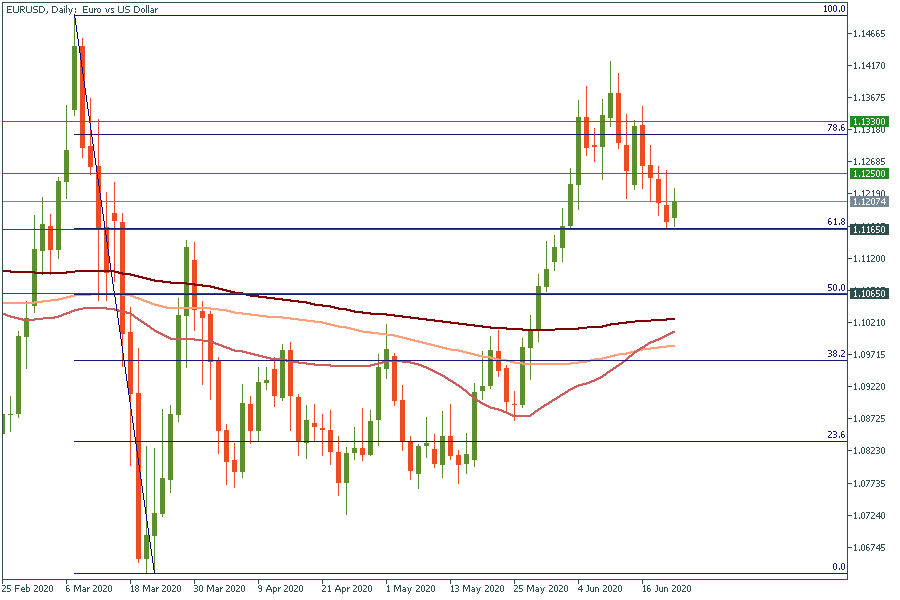

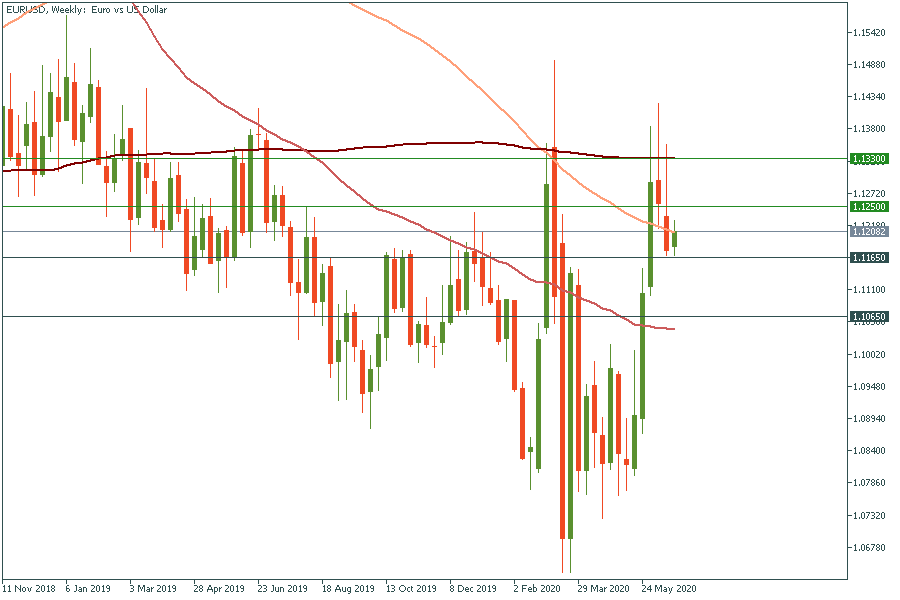

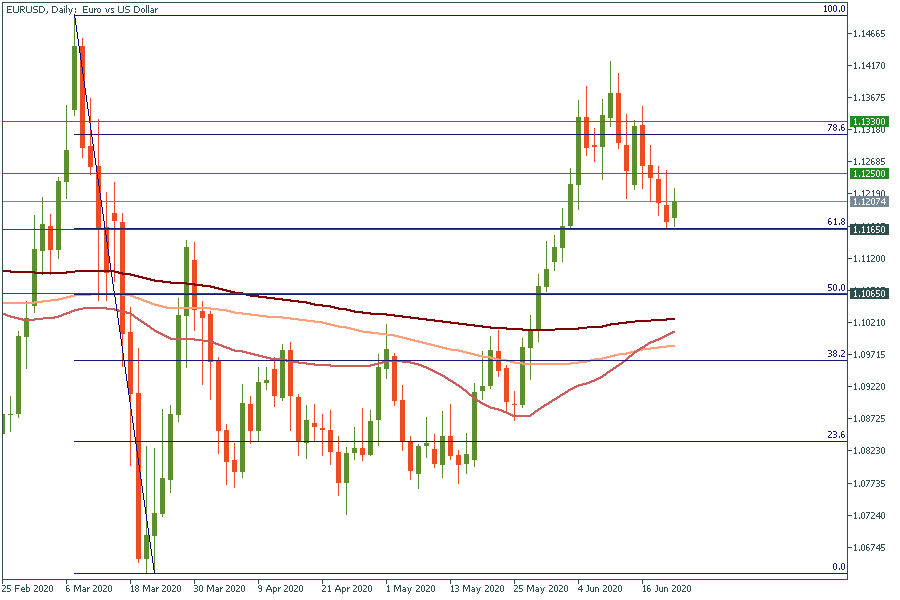

On the weekly EUR/USD chart you can easily notice that the 200-week moving average is the barrier that EUR/USD has failed to break twice during the crisis. It will continue to play this role for the week ahead. The 200-weak MA is currently seen at 1.1330. However, on the daily chart the closest resistance is at 1.125. From the bearish perspective, if it breaks down the support at 61.8% Fibonacci level at 1.1165, it will fall even lower to 50% Fibo at 1.1065. Follow the EU PMI tomorrow!

LOG IN