EURUSD, a major indicator of Euro’s strength, finds itself in a state of indecision, with sideways movement near 1.0850 following two consecutive weeks in negative territory. The absence of clear recovery signals in the near-term technical outlook reflects the cautious stance of market participants. As the pair navigates this period of uncertainty, all eyes are on the upcoming Federal Reserve policy meeting and high-tier macroeconomic data releases, which have the potential to spark significant movements and set the tone for EURUSD in the near future. Traders should remain vigilant and adaptable to swiftly respond to emerging market dynamics.

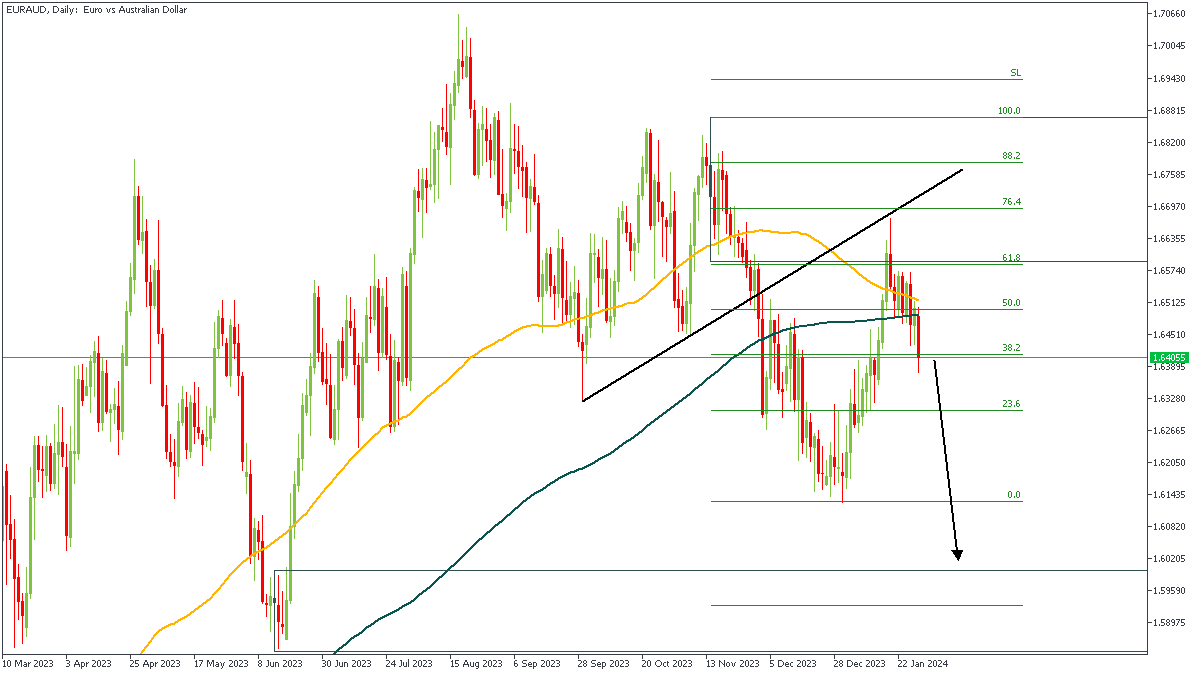

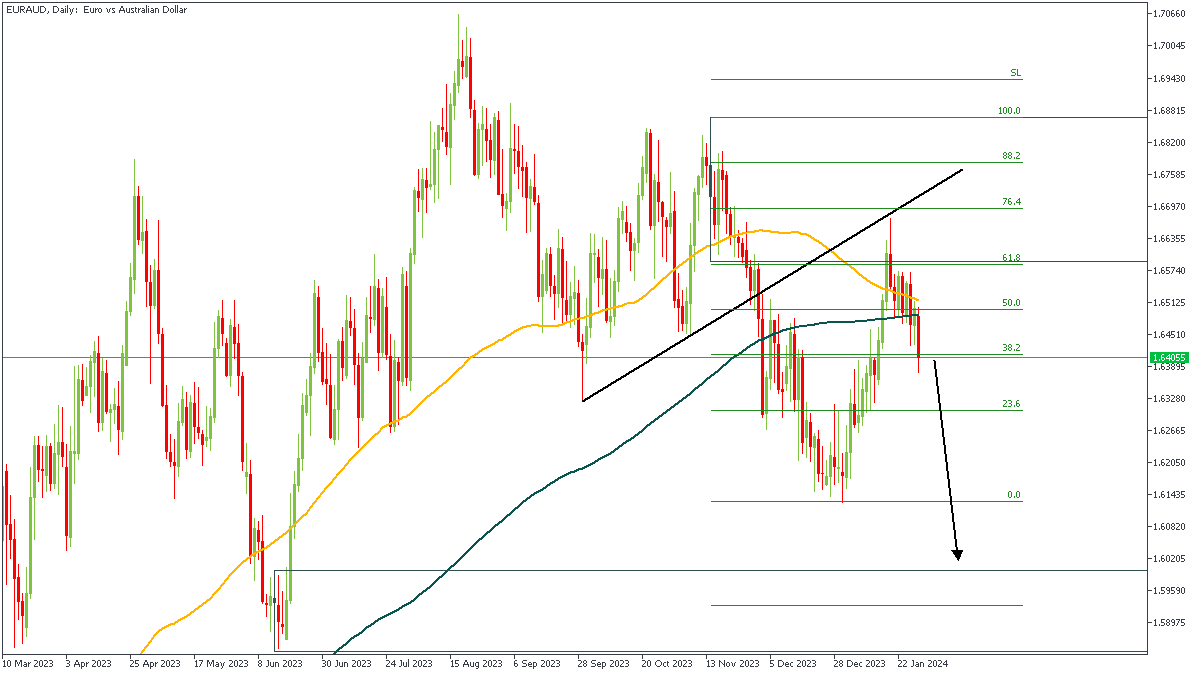

EURAUD - D1 Timeframe

EURAUD has maintained a steady decline on the Daily timeframe after being rejected from the resistance trendline and the 76% of the Fibonacci retracement. What this often implies is the likelihood of price to create a new lower low. My overall target on this EURAUD idea is the highlighted demand zone, though my initial TP is the previous low.

Analyst’s Expectations:

Direction: Bearish

Target: 1.62962

Invalidation: 1.64750

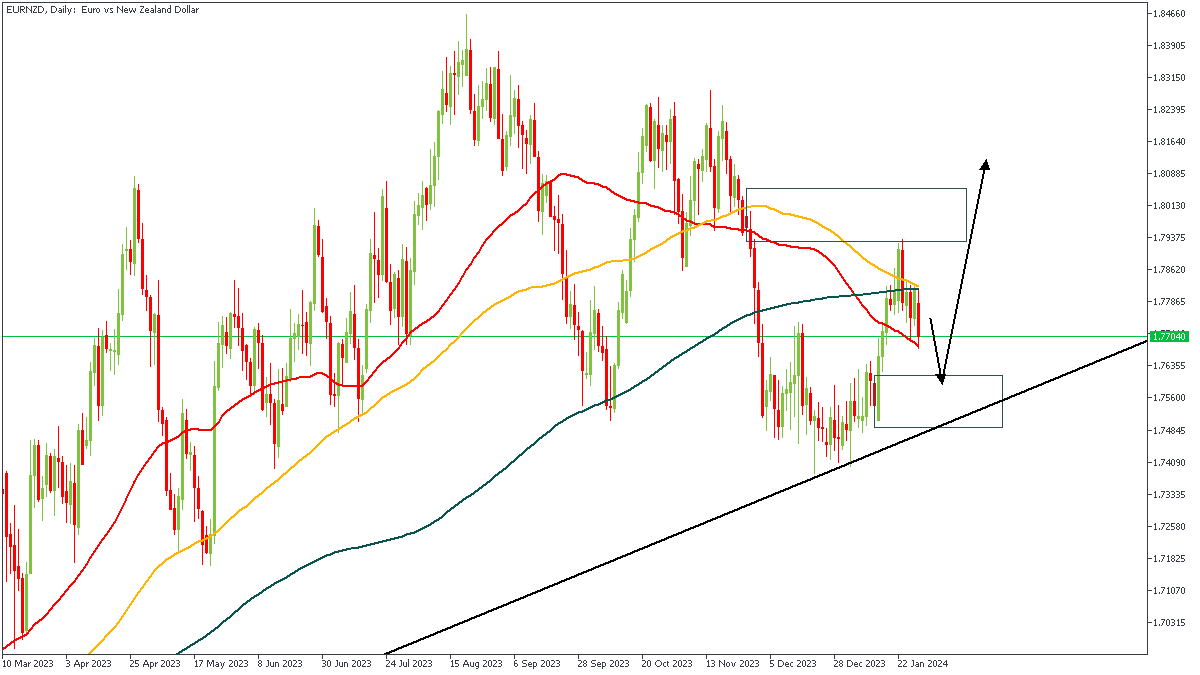

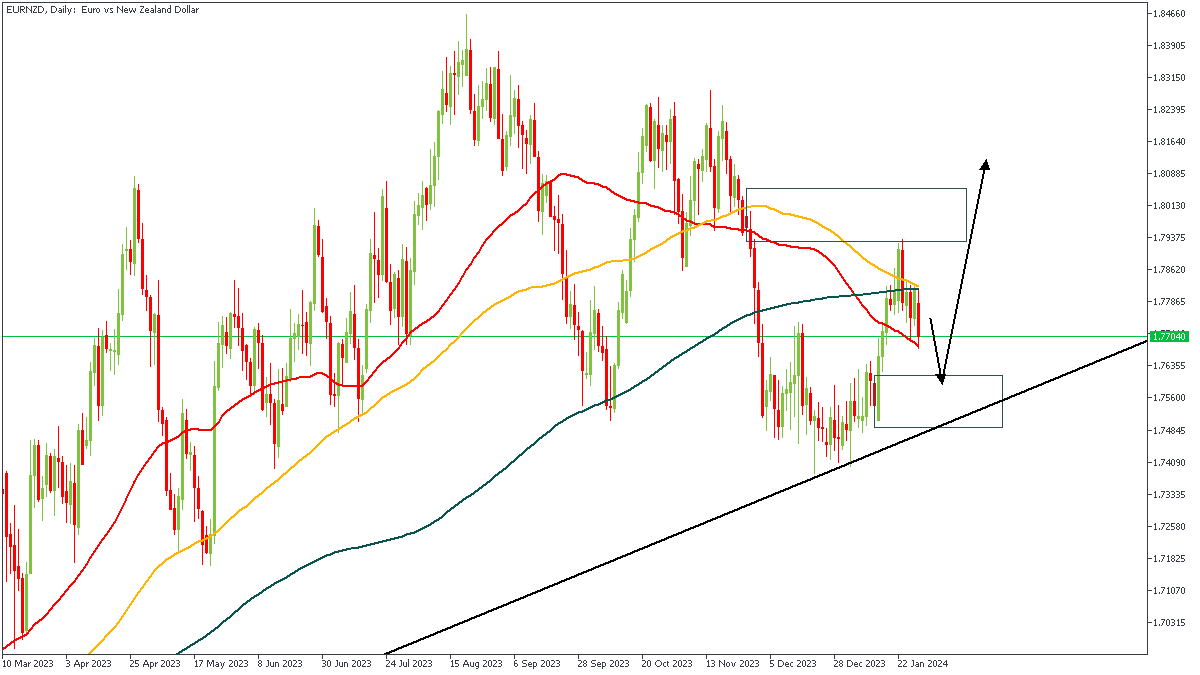

EURNZD - D1 Timeframe

EURNZD has been rejected from the supply zone as shown and could very well be heading towards the demand zone in hopes of making a bullish recovery. The trendline support overlapping the demand zone could incline price to return higher, however, the bearish direction is expected to play out first.

Analyst’s Expectations:

Direction: Bearish

Target: 1.76540

Invalidation: 1.77701

EURJPY - D1 Timeframe

After breaking below the trendline support, the price action on EURJPY got rejected from the trendline and the 76% of the Fibonacci retracement. Based on the confluence from the supply zone, the FIbonacci levels, and the trendline resistance, I will position my entry for a sell with a target around the previous low of the market structure.

Analyst’s Expectations:

Direction: Bearish

Target: 158.127

Invalidation: 160.756

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.