Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2020-11-13 • Updated

Let’s just sort out what’s happening in the UK.

With Brexit - almost nothing. Just another week passed – the one that was supposed to be decisive. Fisheries, the level playing field, and accord enforcement – none of those key sectors of negotiation saw any progress.

With Boris Johnson – really not sure. Hopefully, he is doing fine, because in two days, two of his key allies left him: Lee Cain on Wednesday, after rejecting the position of chief of staff, and Dominic Cummings on Thursday, although he will stay in until the end of the year. Observers are trying to speculate on the reason, interconnection, and Brexit implications of those events, but one thing is for sure: it will be harder for Boris Johnson to assert his power without those people.

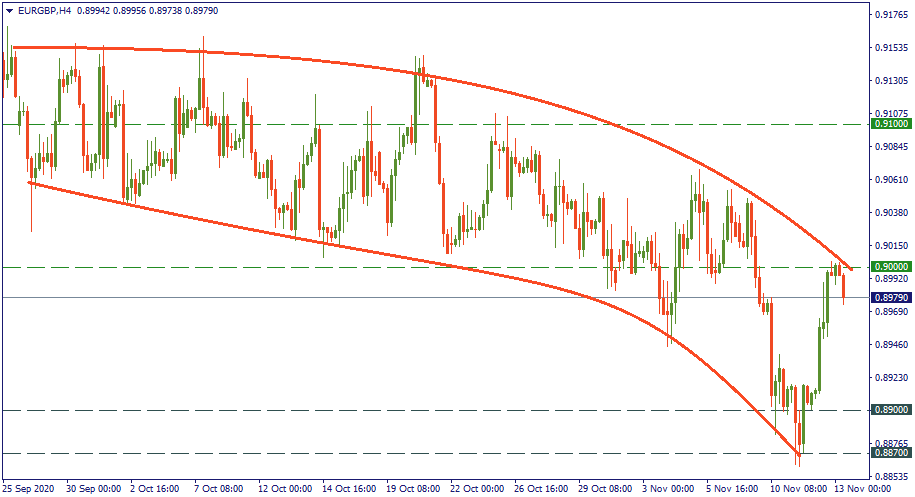

With the GBP – so far, it’s doing fine. Strategically, it hasn’t stepped away from strengthening against the EUR. Tactically, it lost some value, possibly on those two resignations, driving EUR/GBP up to 0.90. It’s already in a downward retrace though, so the GBP is pressing on the EUR again.

We are used to saying “the next week will be decisive” but if there is something that Brexit taught us – it’s that what was announced as deadlines initially, easily converts into just another time-checkpoint for fruitless negotiations. Watch the GBP though – it’s resilience is not limitless.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!