Almost all currencies have loosened against the greenback today, but the GBP keeps rallying. How is it possible?

What happened?

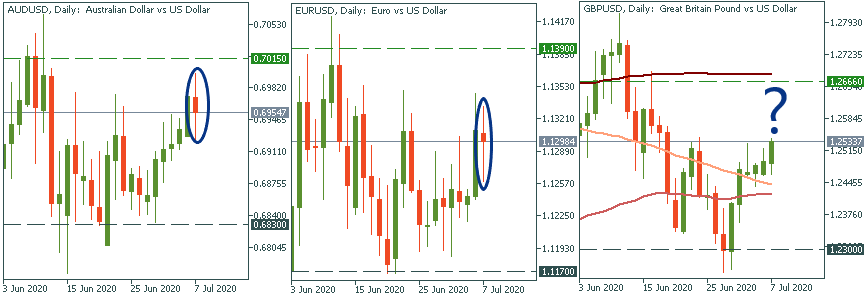

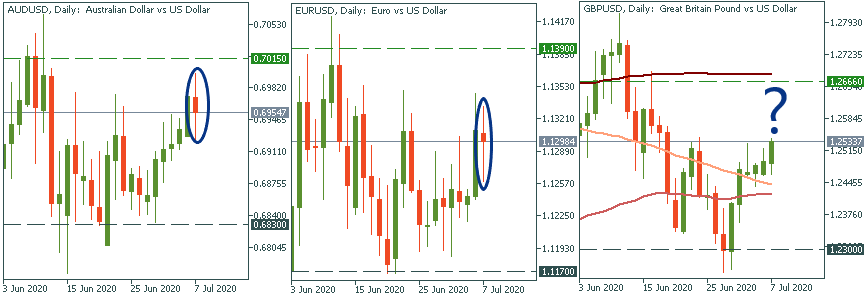

As you can see below: the Australian dollar and the Euro weakened today amid the overall risk-off market sentiment. It was caused by the fresh resurgence of new virus cases in the USA, Australia and some parts of Europe. However, the British pound stays strong, even despite its risk sensitivity. The main reason should be the encouraging data from the UK. The British construction PMI came better than analysts expected. It turned out 55.3, while the forecast was 46.0. Also, today the house price index bet estimates. They contracted only by 0.1%, while analysts anticipated the drop by 0.8%. By the way, the EU’s chief negotiator Michel Barnier arrived in the UK for another round of Brexit talks. Sooner they make an agreement, better for the British pound.

How to trade?

Traders are intrigued as GBP/USD is approaching the key resistance (or as they call it “game changer”) at the 1.253-1.254 area. It’s important because it will define the further EUR/USD movement. Will it continue its 6-day rally or drop following its peers? If it breaks this area through, bulls will win and the price may surge to the next resistance at 1.2595 and then even to the 200-day moving average at 1.2666. Otherwise, it will reverse and fall to the support at the 50-day moving average at 1.2420. The next barrier will be at 1.2300. Don’t lose your chance!

LOG IN