In the middle of August, the British pound got a boost to turn the downtrend. And it seemed that despite uncertainties around the Brexit deal, negative forecasts for the UK economic growth, the GBP found a strength to rise. However, up to now, risks that the downtrend has resumed have been increasing.

UK Pound Sterling Currency Index

Source of the chart: FINANCIAL TIMES

Why the GBP is under pressure?

In the middle of September, the appreciation of the British currency stuck. It’s clear that the Brexit deal is the main driver of the British currency and recent negative events related to the Brexit pulled the GBP down. What is more, the end of the Brexit isn’t close. As a result, traders are curious whether the GBP will be able to recover or not.

On Monday, October 29, UK finance minister Mr. Hammond delivered the budget. Although comments were optimistic: the minister announced an end of the austerity, predicted the economic growth and real wage growth, which is highly positive for the GBP in the long-term, the GBP wasn’t encouraged.

It means that the market keeps worrying about the impact of the Brexit deal. Until it sees confirmations of the soon disposition of the issue, neither strong economic data nor positive comments on the economy will boost the GBP.

But does it mean that the British currency won’t get a chance to recover at least in the near term?

What to expect in the upcoming days?

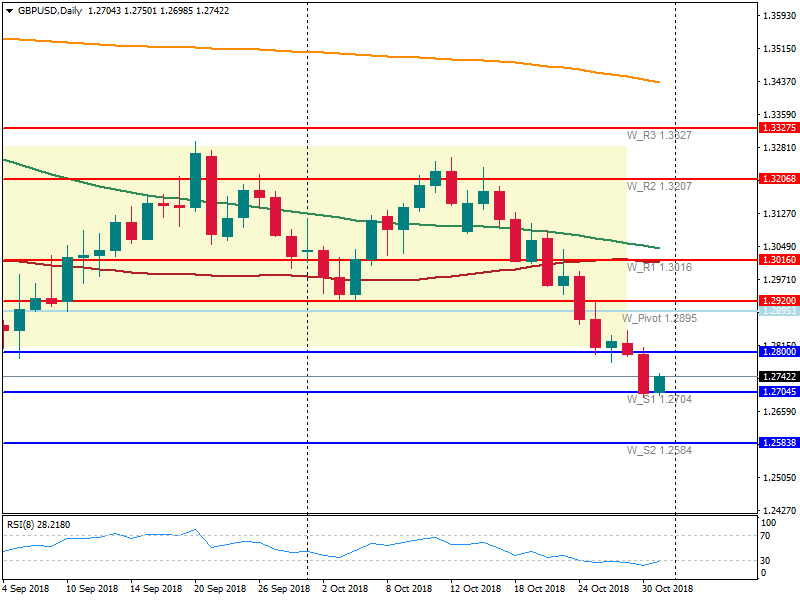

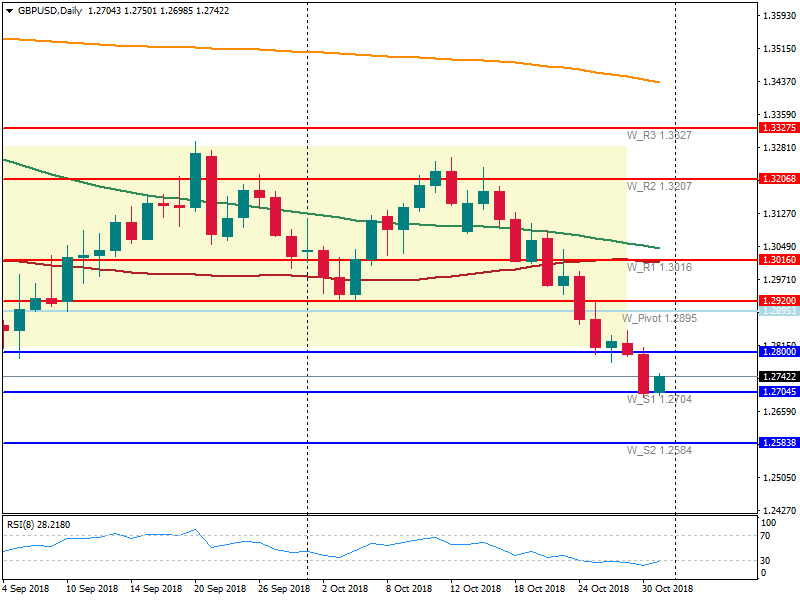

Let’s start with the GBP/USD pair.

The plunge of the GBP was caused also by the strengthening of the USD. The US dollar index has reached the August highs.

Traders are waiting for the Super Thursday. The Bank of England will release the interest rate. Of course, the market doesn’t anticipate any changes to the rate, however, it will try to catch the mood of the central bank. If the BOE is optimistic, the GBP will be supported.

However, on Friday the US will release the jobs data. NFP will make the USD highly volatile, but at the same time, it may help the index to gain a foothold on August maximums.

What levels should we expect?

On the daily chart, the price formed a double top pattern. The neckline at 1.2920 was broken on October 24 and as a result, the pair kept falling. However, on October 30 the pair reached the target at 1.27 and rebounded.

Up to now, we have a question: for how long the pair may rise? Technical indicators don’t give strong signals. RSI is near to cross the 30 level bottom up, it reflects the upward movement of the pair. But the further rise may be limited.

An increase of the GBP will depend on the mood of the central bank. Hawkish Mr. Carney will push the currency up. The resistance will lie at 1.2895 and only the weakness of the USD will pull the pair to 1.3016.

At the same time, we should remember about another scenario. The pessimistic BOE and the strong US jobs data may pull the pair back to 1.27. Moreover, negative comments on the Brexit deal will affect the currency as well. A break of 1.27 will provoke a fall to April lows at 1.2584.

GBP:

Nov 1: BOE Meeting, Manufacturing PMI

Nov 2: Construction PMI

USD:

Nov 1: ISM Manufacturing PMI

Nov 2: NFP

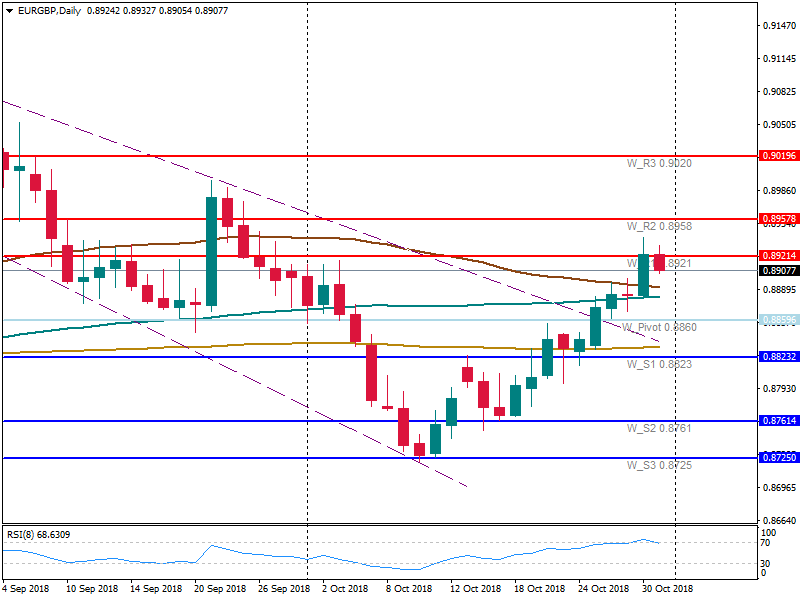

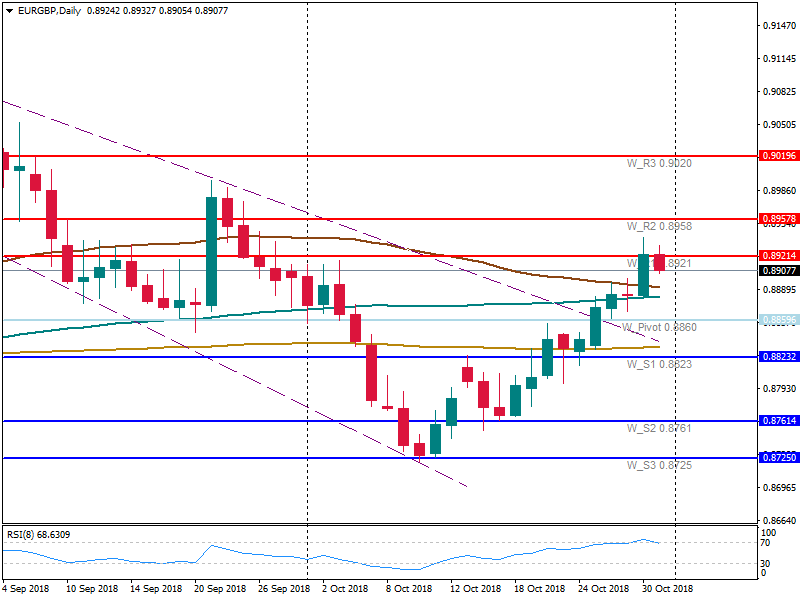

Does the GBP have more chances against the EUR?

The euro has been suffering as well. The most recent event that pulled the euro down was comments of Angela Merkel about her stepping down as a chancellor in 2021. Italy’s budget issue is still a threat for the euro’s rate. However, looking at the chart of EUR/GBP, we see that the British pound is weaker than the EUR.

On October 31, the pair managed to rebound from the resistance at 0.8791. The RSI indicator is near to cross the 70 level upside down that signals about the downward movement of the pair.

The further direction of EUR/GBP will depend on the BOE statement and the ability of the euro to recover. In case of the pessimistic mood of the BOE and negative economic figures, the pair will be able to break above 0.8921. The next resistance is at 0.8958.

However, if the euro doesn’t gain momentum and traders consider the BOE statement as positive, the pair may go to the support at 0.8860.

Events to look at:

GBP:

Nov 1: BOE Meeting, Manufacturing PMI

Nov 2: Construction PMI

EUR:

Comments on Italy’s budget

Making a conclusion, we can say that the GBP has a chance to rise. However, in the upcoming day, comments on the Brexit deal, the mood of the BOE, strength of the USD and European news will affect the moves of the GBP/USD and EUR/GBP pairs. Follow the economic calendar and the news to be sure in the further direction of the GBP.