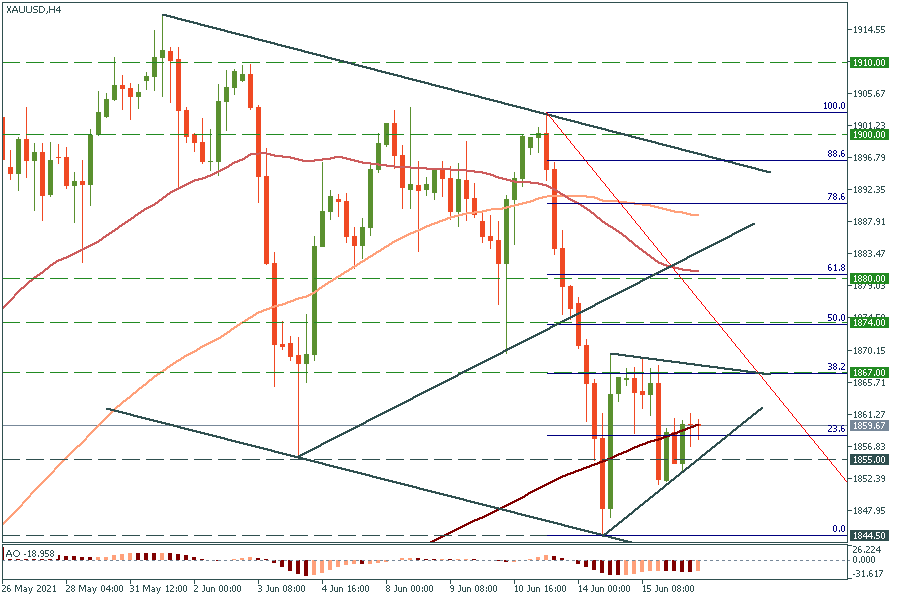

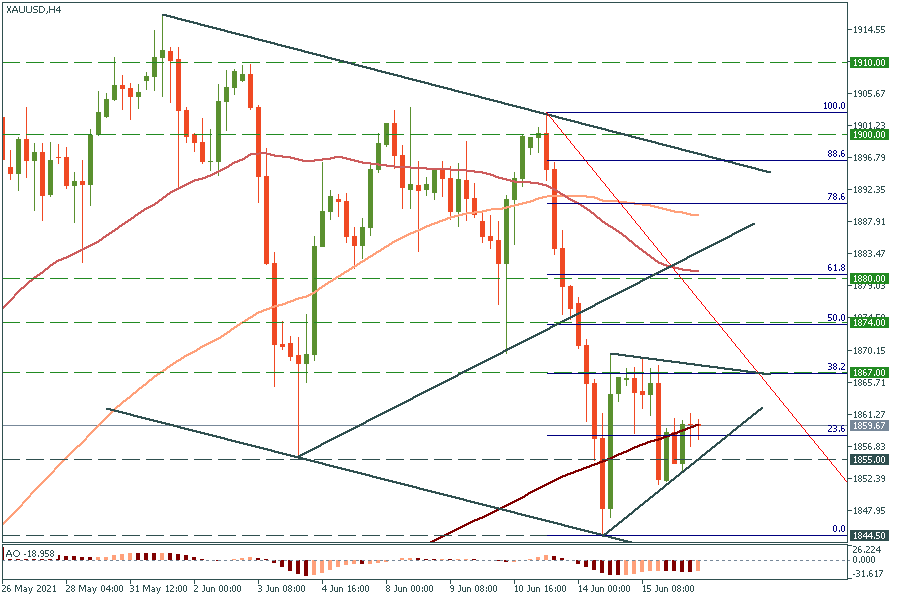

Everyone is interested in trading gold (XAU/USD). The meeting of the Federal Reserve at 21:00 MT time (GMT+3) will certainly drive the price. In this article, however, we’ll look at the technical side of things to see what opportunities lie there.

First, the uptrend since the end of March is still in place. On the weekly chart, there’s a 50-week MA just below $1855 – this level is supporting the price.

Second, on the D1 an Inside bar formed yesterday: it’s a sign that the price is consolidating ahead of the major breakout. The decline below $1855 will open the way down to $1845/$1840 (200-day MA). If XAU/USD stays above $1855, it will rise to $1867. A further breakout will bring the price shoot up to $1874 and $1880.

A more detailed picture of all the levels is offered by the H4 timeframe:

Trade ideas for gold

BUY 1862; TP 1867; SL 1860

BUY 1869; TP 1880; SL 1865

SELL 1854; TP 1845; 1857

START TRADING