USD/ZAR is mainly driven by the US dollar, that’s why the US economic data is highly impactful. The US has published strong retail sales for August. It pleasantly surprised investors as they were concerned that consumers would limit their purchases amid the spread of the Delta virus strain. However, retail sales posted a gain!

|

|

Actual

|

Forecast

|

|

Core Retail Sales m/m

|

1.8%

|

-0.1%

|

|

Retail Sales m/m

|

0.7%

|

-0.7%

|

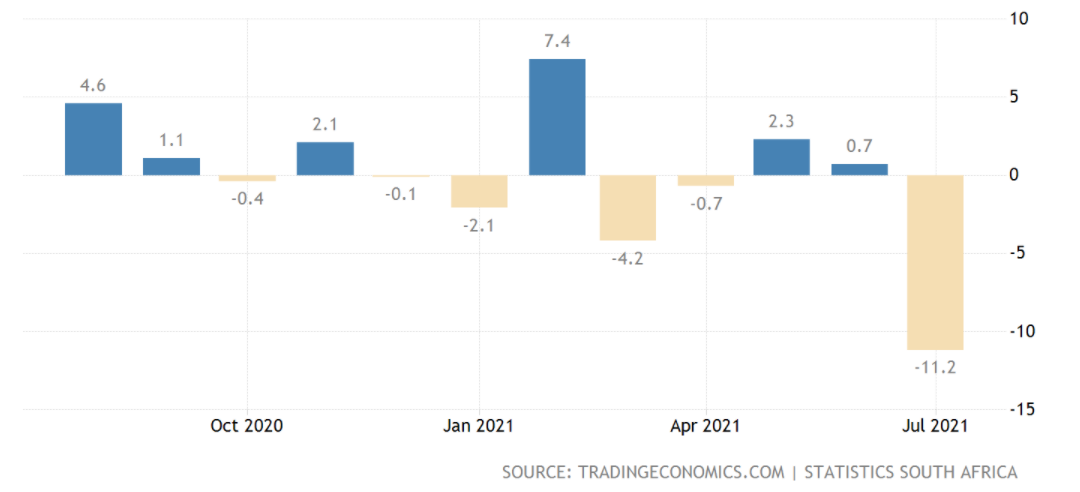

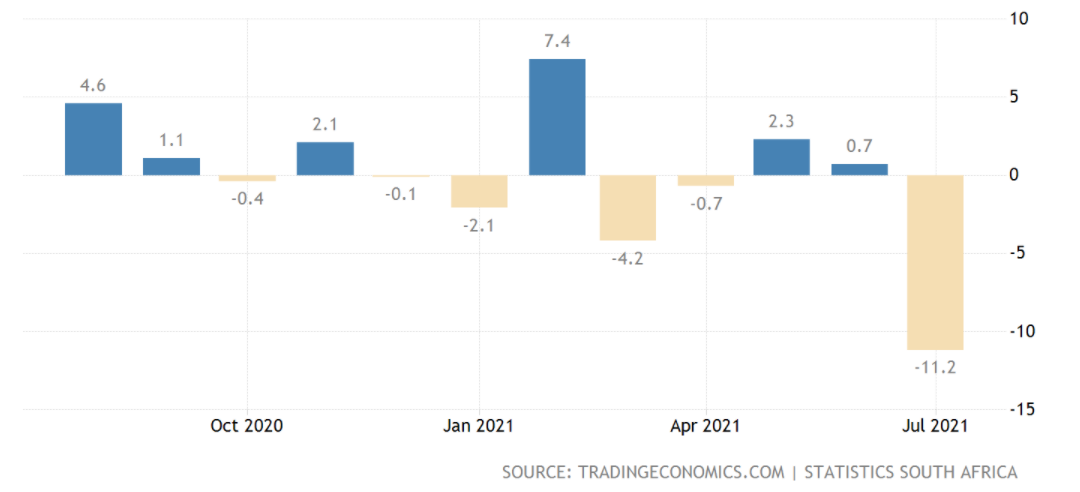

In comparison, South Africa's July retail sales (the freshest data so far) revealed a significant -11.2% year-on-year, versus market expectations for -2.7%. Such a huge drop was caused by the jailing of former president Jacob Zuma, which lead to the escalation of civil unrest.

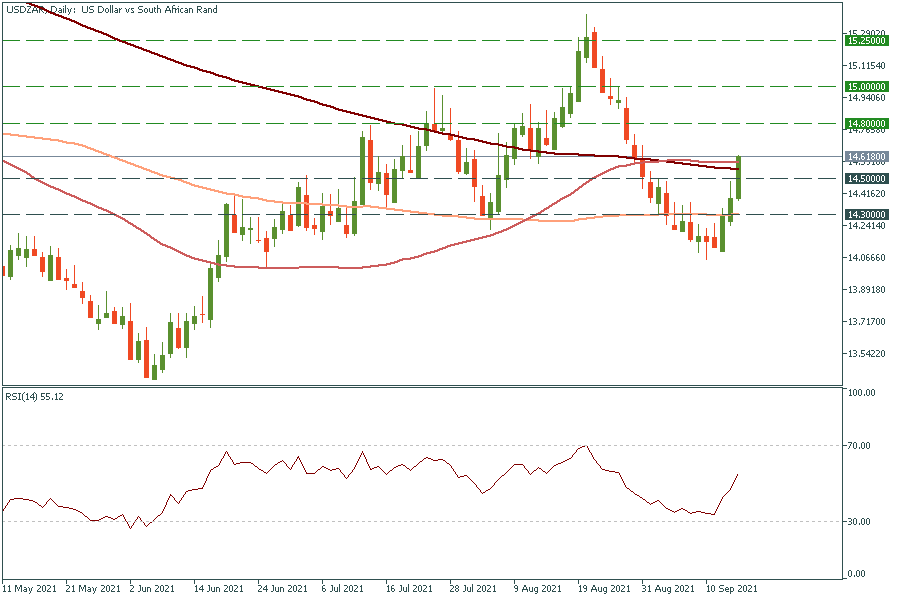

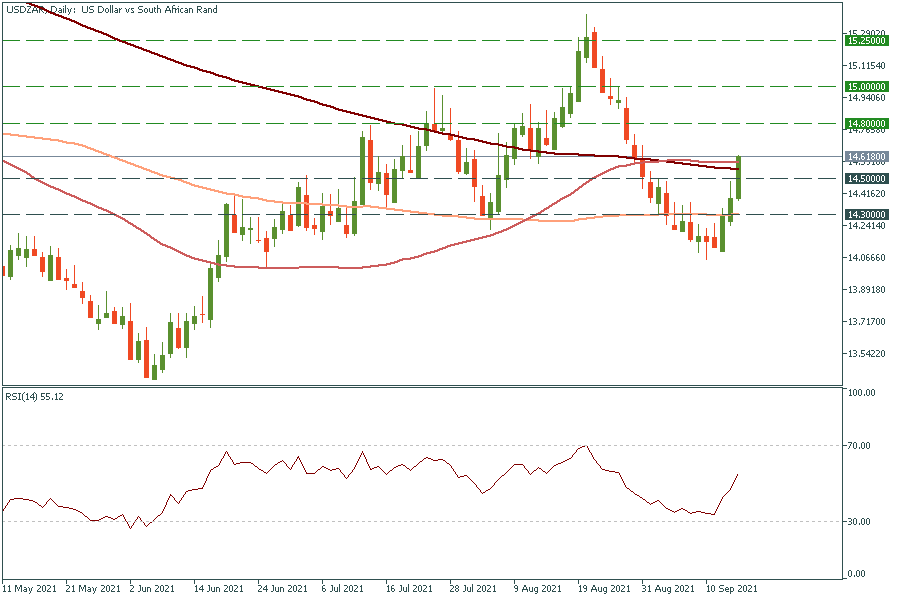

Technical outlook

USD/ZAR has been rising at a quite fast pace for the last three days. It has even broken through all three moving averages: 50-, 100-, and 200-day. The growth has been too quick though, we might expect a retracement (correction) to the support level of 14.50. However, the rally may continue till the price reaches the highs of early August at 14.80. The breakout above this resistance level will lead the pair to the psychological mark of 15.00.

TRADE NOW