This Thursday, at 22:00 MT time, IBM reports Q4’2020 performance. What is there to expect?

Figures

The average consensus for the expected Q4 earnings is $1.77 per share (62.4% less than a year ago) while the sales prognosis stands at $20.51 bln (5.8% less than in 2020).

Fundamental

The last quarter of a year is traditionally a strong season for IBM. Therefore, it’s supposed to have made pretty good sales, marked down on the virus hit, of course. On top of that, the company made certain acquisitions and announced promising spin-offs (NewCo) that are seen as solid steps to strengthen its strategic position.

Technical

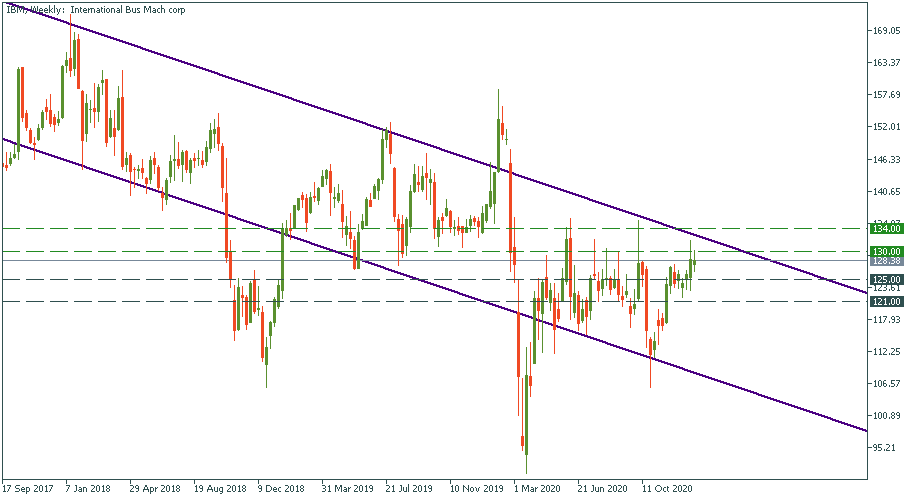

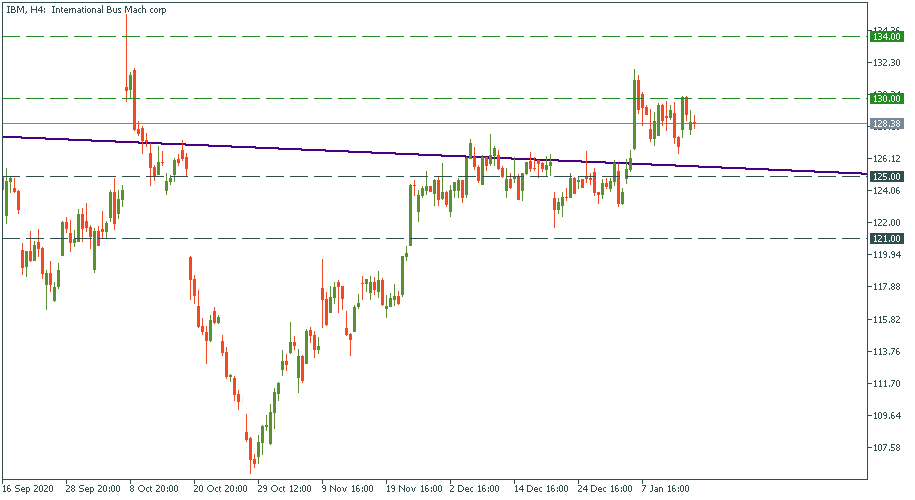

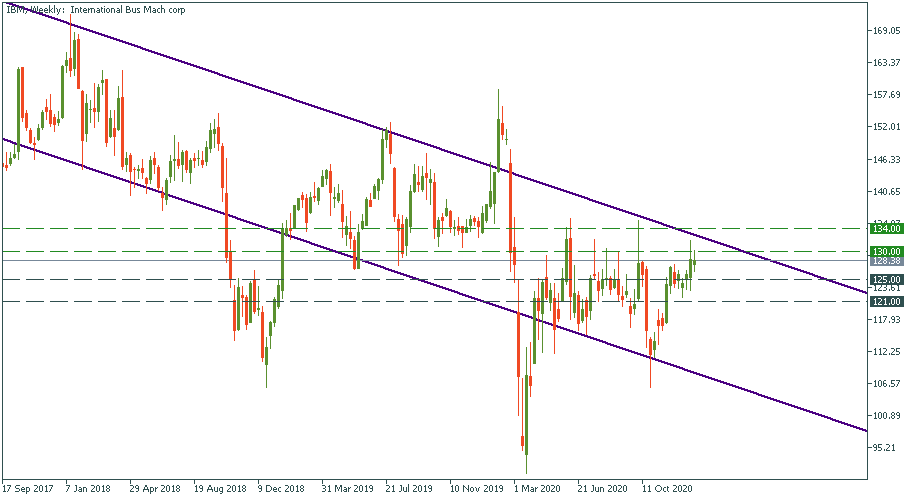

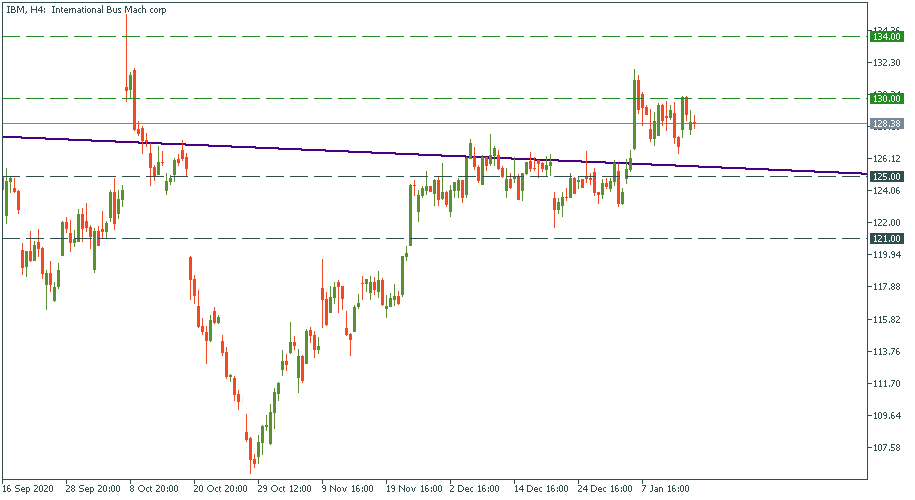

While IBM is definitely a titan of the US stock market that spearheads the IT industry, it’s been constantly struggling to bring consistent revenue growth during the last years. The latter is one of the primary concerns for investors – hence, the large downtrend. The current level is right at the upper side of the trend. Therefore, it is but logical to expect a high probability of a bounce off and a downward reversal.

$134 is expected to be the target for bulls if the report on January 21 beats market expectations. While the stock price may go even further above in this scenario, it is still believed to be likely to go downwards in the long-term. That is, unless IBM changes its financial performance, revenue generation dynamics, and, thus, investor impression about it.

$121 may be a likely bearish target is IBM underperforms. In the context of the large downtrend it’s been in, dropping to this support level may be more a question of time rather than a possibility.

Therefore, it is more advisable to take a bearish position in the mid-term and long-term with the IBM stock. Otherwise, in the short-term, bulls may deliver a surprise blow to the market and take the stock price to the upside only in case the figures on Thursday are better than though.

The week January 25-29 will bring many more earnings reports from other copmanies. We will keep you updated!

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you’ve downloaded Metatrader 5.FBS allows you to trade stocks only through this software.

- Open the MT5 account in your personal area.

- Reveal all trading instruments by clicking “show all” at the “Market Watch” window.

- Start trading!

LOG IN