What happened?

The last week has ended with greater-than-expected NFP, but weaker average hourly earnings. 916,000 people were employed during March, while the forecast was only 647,000. Average hourly earnings dropped by 0.1%, whereas growth of 0.1% was anticipated. As a result, since NFP comes better, but earnings – worse, the USD will spike at first, but it will fall with the second wave.

Europe’s poor vaccination rollout and prolonged lockdowns keep pressing down the EUR. Unlike the EU, the USA is in a much better position. Biden claimed a goal of 200 million vaccinations in his first 100 days and unveiled the 2$ trillion infrastructure plan. As a result, Treasury yields surged. And as we know, rising yields would push the US dollar up.

Forecast

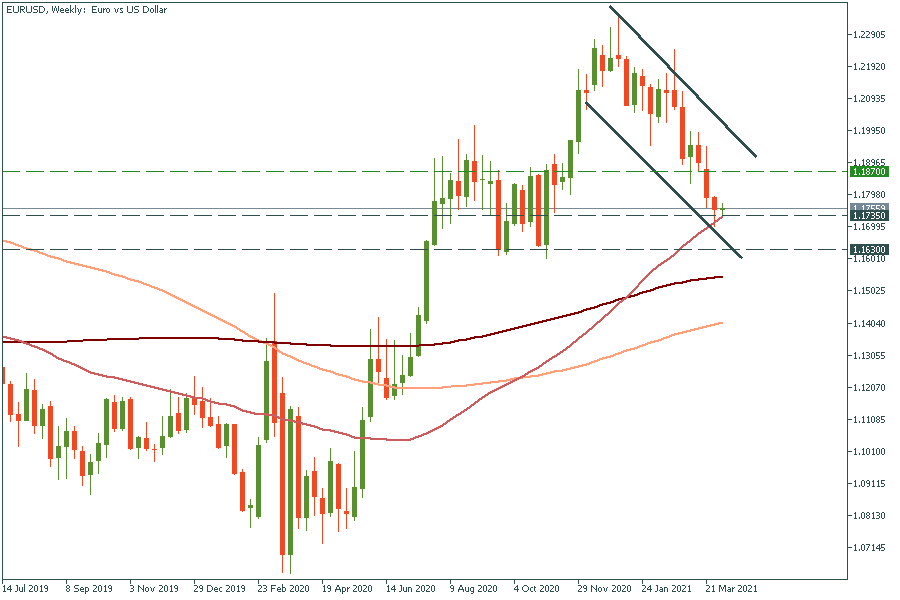

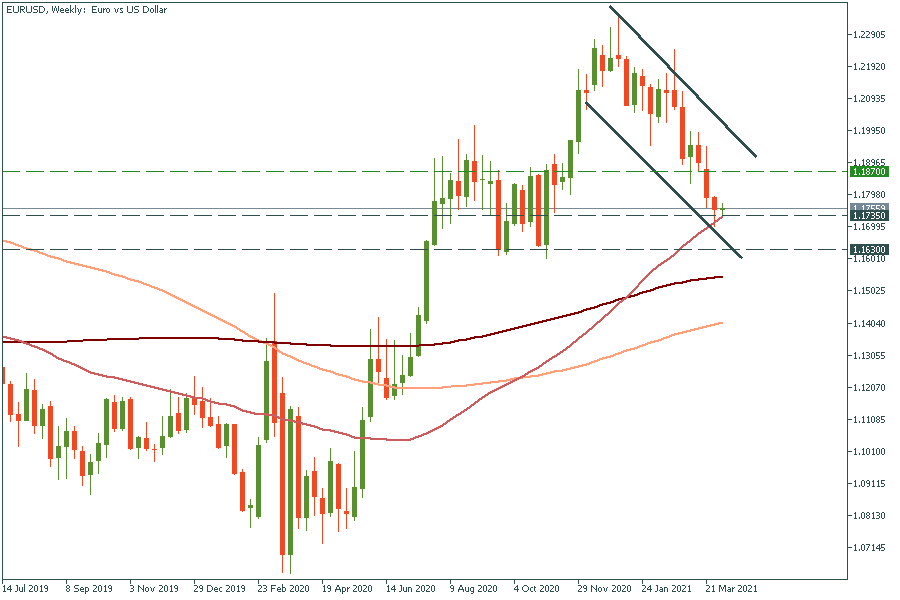

According to ING, EUR/USD is likely to dip further this week. So far, support at 1.1700 has been held, but the pair may break down to the low of 1.16 this week.

Technical analysis

EUR/USD is moving in a descending channel. On the weekly chart, the way down is constrained by the 50-week moving average of 1.1735. If it manages to break it and then crosses 1.1700, it should fall to November’s low at 1.1630. On the flip side, if it crosses the high of April 2 at 1.1790, it may jump to the 200-day moving average of 1.1870.

TRADE NOW