Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

2021-08-31 • Updated

On the last summer day, we would like to offer you to watch these significant upcoming moves.

Asian market finally enters recovery stage as Chinese (HK50) and Japanese (JP225) indexes demonstrate bit pump on Tuesday, August 31.

Let’s check the charts and set targets for this move!

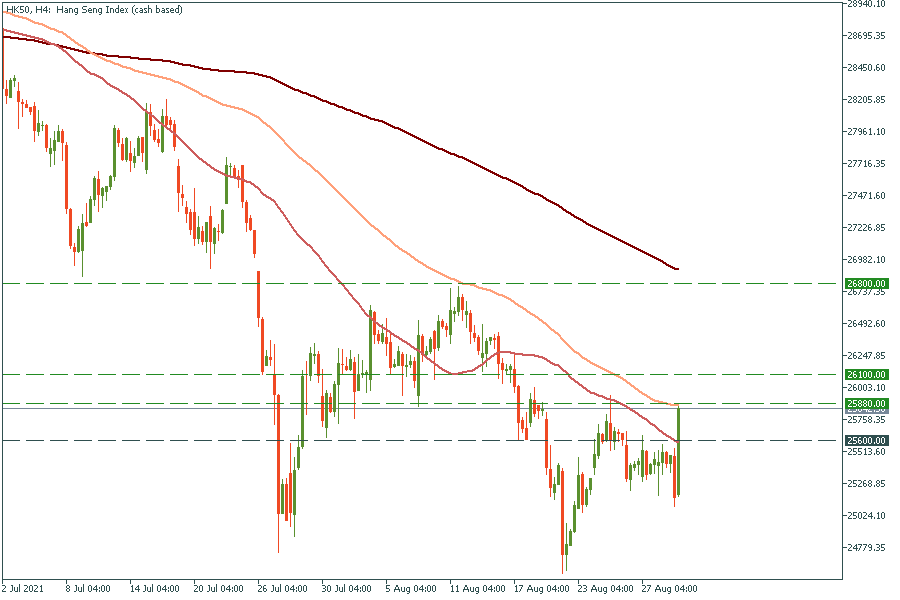

4H chart

Hang Seng 50 came to the 25.880 resistance level which matches with the 100-period moving average. It looks like buyers are taking it seriously and ready to push it higher. As soon as the price breaks this resistance level, we will get two targets of 26.100 and 26.800 levels respectively.

Daily chart

JP225 has formed a falling wedge pattern on the daily chart. The price is heading towards the 28.500 resistance level, which matches with 100 and 200-day moving averages. After the breakthrough, the price will move towards the previous high at the 30.500 level. The main support is 26.900, which is the bottom line of the wedge.

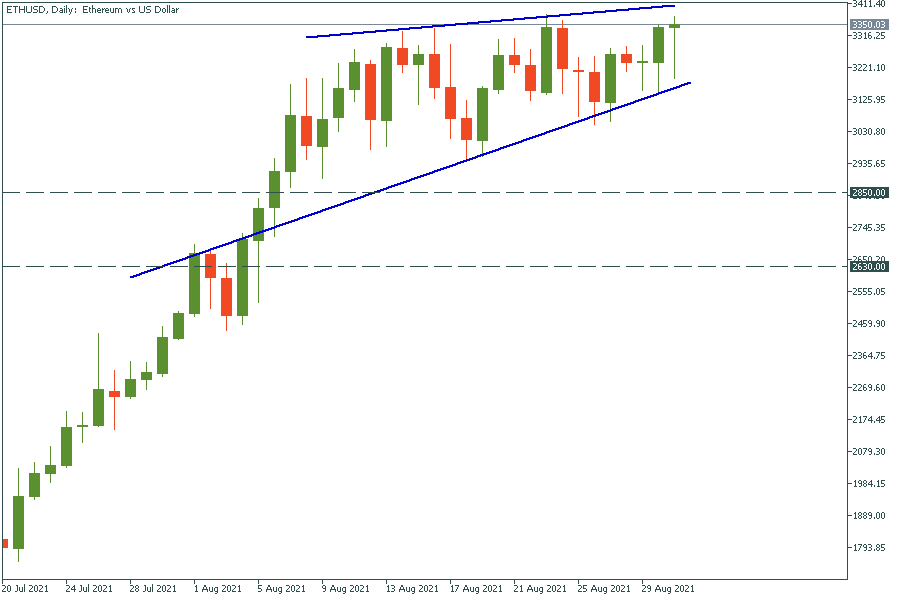

4H chart

Ethereum price has formed big resistance and support levels. The only way to trade this crypto asset is to wait until the battle between bulls and bears will be finished and join the winners. If the price breaks the upper line of the rising wedge, Ethereum will pump to $3550 and $3800. Otherwise, we might see a big correction to the $2850 and $2630 support levels.

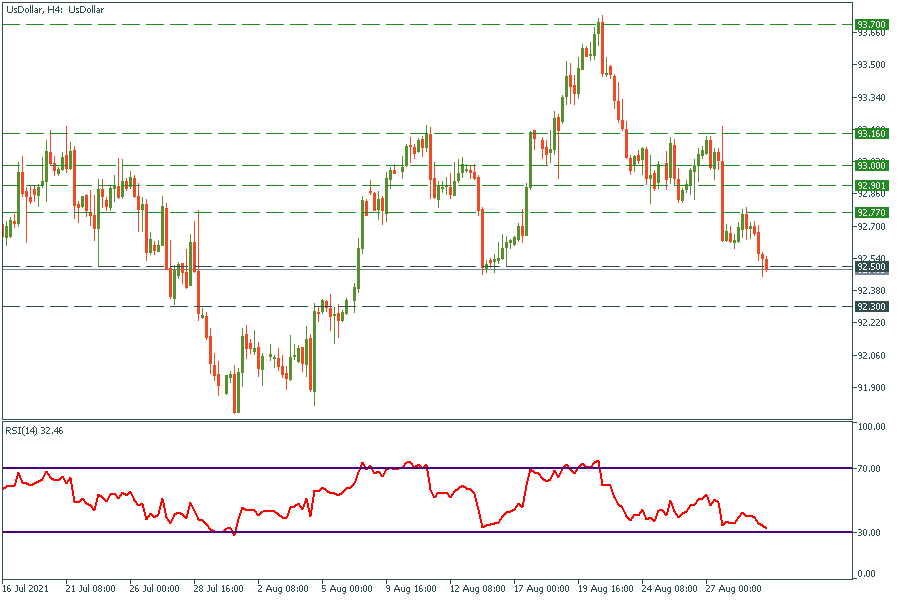

4H chart

It looks like the US dollar index is not going to give up so easily. At the moment, it is consolidating around 92.5. Combining with the RSI close to the oversold area we might suggest that the pullback is coming soon. The main target of that movement is 92.77. Unfortunately, if the US dollar index breaks through the 92.5 support level it will immediately drop to the next support, which is 92.3.

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

As the year winds down and the festive spirit takes hold, the stock market often presents a curious yet anticipated phenomenon known as the Santa Rally. Within this whirlwind of festive trading, let’s look at how two titans of the tech world, Amazon and Apple, might fare during this unique season.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!