The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

2020-06-24 • Updated

Encouraging economic releases underpinned stocks bulls. What tech names pushed Nasdaq up?

Investors became more confident in the smooth recovery as economic indicators of most countries turned out better than expected. For instance, US new home sales rose to 676,000, while analysts forecasted only 637,000. The US manufacturing and service PMI surged to 49.6 and 46.7, what was slightly less than the 50.0 threshold that indicates the economy expansion. Anyway, investors welcomed that data as it signaled economic stabilization. Of course, the current economy is still well below pre-crisis levels, but stocks are forward-looking. They tend to rise before the official way out of the recession. Moreover, the tech industry has risen amid the coronavirus and it still has the strong potential for further gains.

The unrivalled leader among its Nasdaq peers is Apple. Thanks to the tech giant’s growth Nasdaq surged to unseen levels for its history. Apple held its Worldwide Developer Conference and released its new software and revolutionary processors for Mac computers, which turned out more efficient than Intel ones. The Apple stock’s price gained on that news. Now it’s heading towards the recent high at 372. Nevertheless, if it breaks down the support at 350, it may fall even deeper to 335.

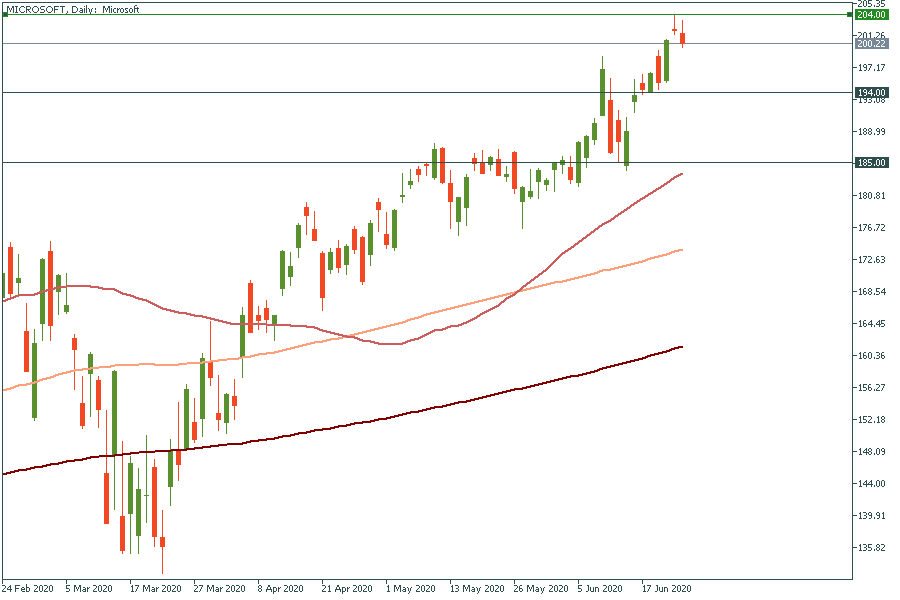

Wall Street analysts have bullish prospects for Microsoft as it approaches its next earnings report date. They anticipate the year-over-year growth of 2.19%. Also, if we look back on the impressive earnings growth and robust cash flows of Microsoft, we will find the stock still undervalued. That is the reason why most analysts believe that Microsoft is a strong buy. The price of the Microsoft stock reached the all-times high at 204 and contracted a little bit. Anyway, support levels are 194 and 185.

Finally, Facebook concludes the top three Nasdaq components. Facebook co-founder Mark Zuckerberg hugely contributed to push Facebook into the world's largest social network, and acquired Instagram, WhatsApp, and Oculus VR to develop its ecosystem. People started using these apps more often amid the stay-at-home regime. Notably, voice and video calling more than doubled on Messenger and WhatsApp. Since Zuckerberg has a passion to monetize all these platforms, we can assume that the stock price will rise soon. If the price crosses the recent high at 245, it will surge further. Otherwise, if it falls below the support at 230, it may drop lower to 223.

The energy industry has undergone several major changes in the XXI that are becoming increasingly apparent…

More and more analysts are sure Brent oil will surpass $100 a barrel. So how heavily will oil move the markets, and what will the direction of the movement be? Let's find out!

About PayPal PayPal is an electronic commerce company that facilitates payments between parties through online transfers…

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!