Oil is trading higher for the second week. For how long?

The crude oil price is moving up due to many reasons. First of all, the market is hungry for risk because of optimistic US-China trade talks and reopening of economies all over the world. Also, the ease of lockdowns leads to more consumption and more demand. For example, gasoline consumption rose significantly in the USA. Moreover, factories are coming back to work and need more energy.

To everyone’s surprise, Saudi Arabia, the world’s largest oil exporter, set higher the oil price for June. The country claimed that its main interest is to bring back pre-crisis prices, stop competing for the market share and end the oil war.

Buyers, especially China, were quite disappointed by the Saudi pricing decision. The price was higher by $1.40 a barrel, while the $7.50 contraction had been expected. Now, the oil demand should rise strongly to support these high prices.

Some analysts have a genuine hope in the oil rebound, while there is still a massive glut on the market. According to Goldman Sachs, global oil demand is rapidly recovering and it may even surpass the supply by June. It’s hard to believe right now, but who knows.

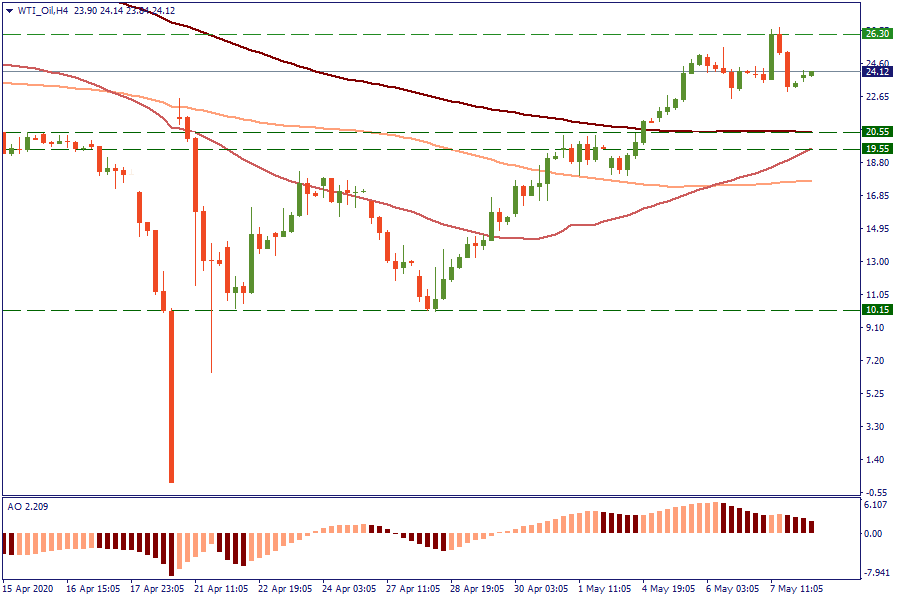

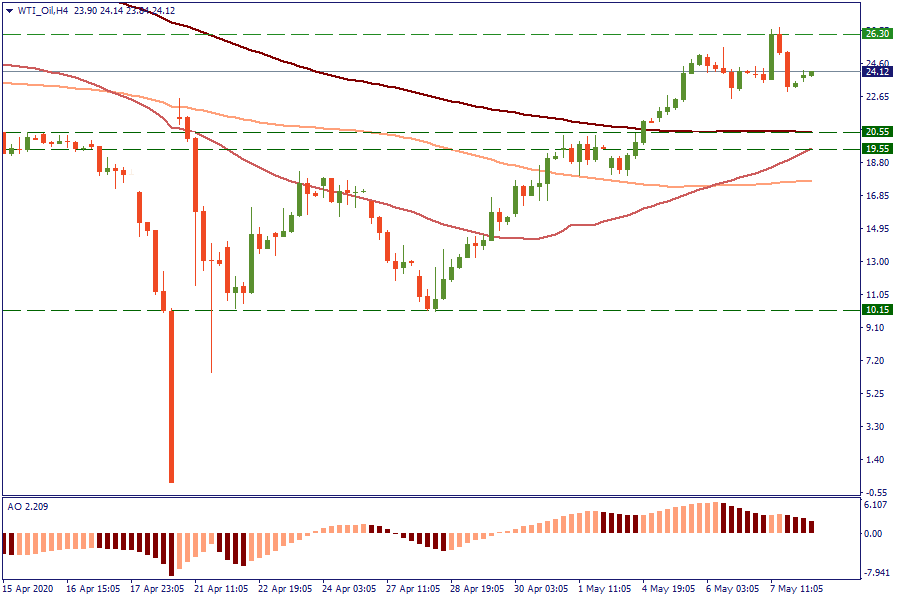

Let’s look at the chart. The price is approaching the 25 mark after the recent low at 10.15. If it crosses the resistant line at 26.00, it may continue its rally to 29. The next resistant line is at 35. Support is at 20.00.

To trade WTI with FBS you need to choose WTI-20M in MT4.

LOG IN