Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-04-05 • Updated

OPEC+ meeting last week was concluded with the following results:

The decision was rather unexpected. While some of the cartel’s members (Russia) were known for pushing to roll back oil supply, most of the other members were believed to follow a conservative and cautious course of Saudi Arabia. The latter advised it’s time to “test” the market and review results on April 28 when the next meeting is scheduled.

However, while the OPEC’s decision was a result of inner compromise rather than a true belief in the confident demand recovery, observers are not pessimistic on the latter. Therefore, the upside is still a possible projection area for the oil price.

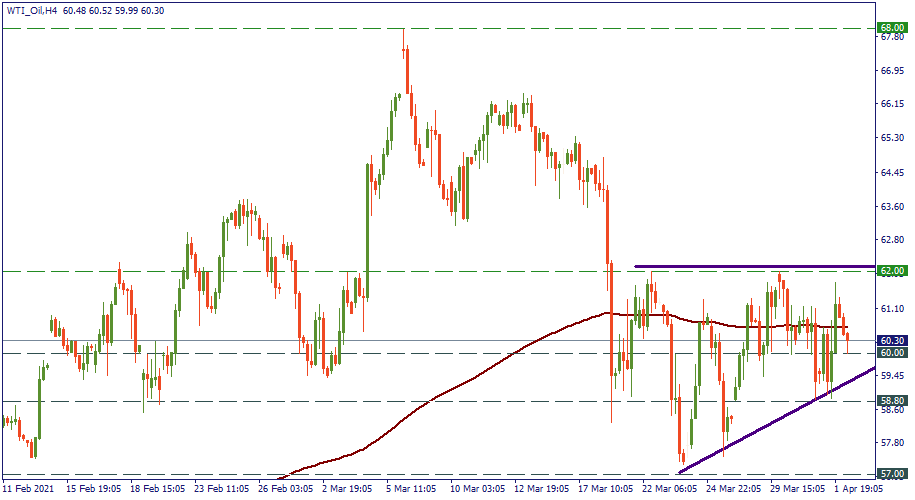

Currently, WTI oil is fluctuating around $60. After it reached $68 at the beginning of March, it never came back. Moreover, it lost more than $10 of value dropping to $57 later on. Since then, higher lows have been forming suggesting that the downward correction may be over. As the technical pattern of the triangle indicates, sideways movement may extend through the middle of April until bulls come back to take over and break the resistance of $62.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!