Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-08-06 • Updated

Since the beginning of the week, Brent lost 6%. It was caused by several factors, which are described in this article. Let’s discuss them and find out how will oil price move during upcoming OPEC-JMMC meetings!

Data out of China shows that factory activity growth declined in July, which is the first time in over a year. Also, 46 cities have been locked down in China due to the COVID-19 pandemic. This fact concerns investors as China, the largest oil consumer in the world, might reduce the demand as its economic growth slows.

The ISM Manufacturing index of national factory activity fell in July. Data released by Automatic Data Processing, the payroll company, revealed that although the private sector added 330,000 jobs in July, that is less than experts predicted (653000 jobs) and less than half the number of jobs added in June. Moreover, the Energy Information Administration reported that crude oil stockpiles increased last week, though gasoline inventories fell. Experts suggest that oil stockpiles increase was caused by export drop but not domestic demand.

In this case, traders should pay attention to export numbers, as falling export can signal worldwide demand decrease.

OPEC’s oil production hits the largest numbers since April 2020. In July 2021, the organization decided to increase output by 400000 barrels daily and plans to increase it monthly at the same number through April 2022. This could affect world supply as coronavirus lockdowns return.

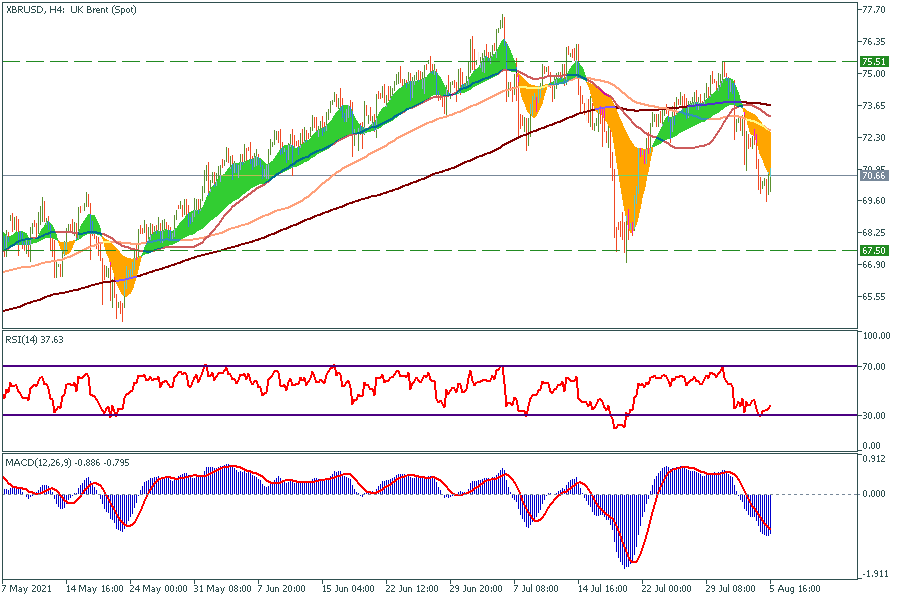

4h Chart

At the moment, $67.5 is the main support level. Until Brent's price is higher than $67.5 uptrend is going to continue. The RSI and MACD show that the price is going to reverse soon and go up to $75.5. If Brent breaks this resistance, the next target will be $80.

Fundamentally, trend reversal could be caused by news from India. The data shows that gasoline demand grew by 646000 BPD in July, despite India’s second place in coronavirus cases. This country imports almost all the crude oil it needs.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Coinbase (#COIN) saw its revenue rise to $773 million in Q1 2024, marking a 23% increase from the previous quarter and surpassing analyst expectations.

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!