Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

2020-06-19 • Updated

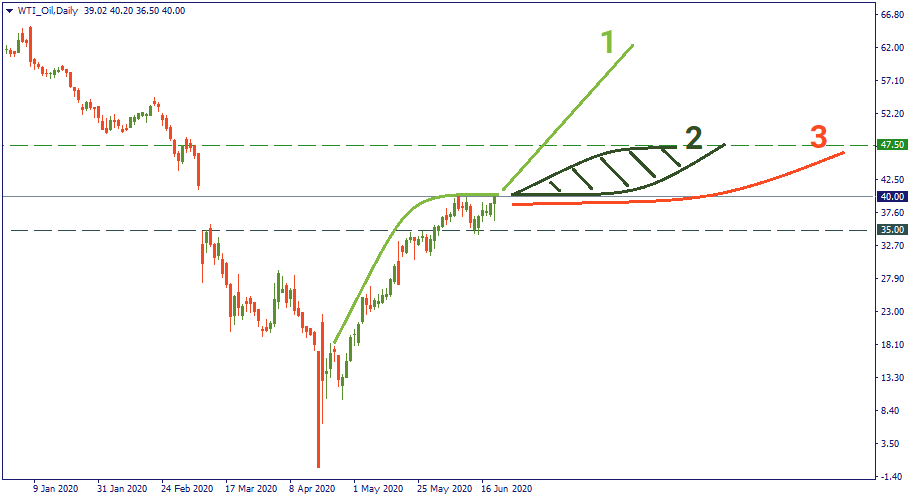

After spending the entire April in the depths below $20, WTI oil made a straight-line recovery in May. Eventually, it reached $40 on June 8 after which it went into a first serious downward retrace. Currently, it is at $40 again, and the question is how the situation will evolve.

Fundamentally, the demand for oil seems to be recovering globally – at least, that’s how OPEC sees it. That’s why $40 is likely to be eventually stepped over. The question is – when?

The most optimistic scenario (trajectory “1”) suggests that the following movement will be as straight upwards as it was during May. Although that is possible, it is not the safest assumption to rely on. The signs to look for would be decisive moves upwards during the next week. If it happens, it would mean the oil price is firmly established now above the baseline level of $40.

The moderate – and the most probable – scenario (trajectory zone “2”) suggests a gradual ascent into the channel between $40 and $47.5 throughout the next two weeks. That will be possible if there will be no bad news for oil. The higher it gets, though, the heavier it will become, and each step upwards will require more positive informational input.

The slowest (but still quite optimistic) scenario (trajectory “3”) assumes that the oil price will go into consolidation at the current level of $40 and will stay there during the next week waiting for OPEC, US, or Russia to come with more fundamental input. Eventually, it will come to challenge the resistance of $47.50 anyway, but later on.

Today’s moves may give us a clue about which of those scenarios will be most likely to happen so let’s watch oil carefully today.

Last week marked the consolidation for the most active assets of March 1-15 (which is oil and gold). But next week has a lot to show, be ready to take part!

Why brothers? If you put an oil chart on the S&P500 chart, you will find out that these assets have a strong correlation…

Besides US Retail Sales data, Australian Unemployment Rate and New Zealand GDP this week will bring us Quadruple Witching – one of the four most important days of a year for futures and options!

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!