Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

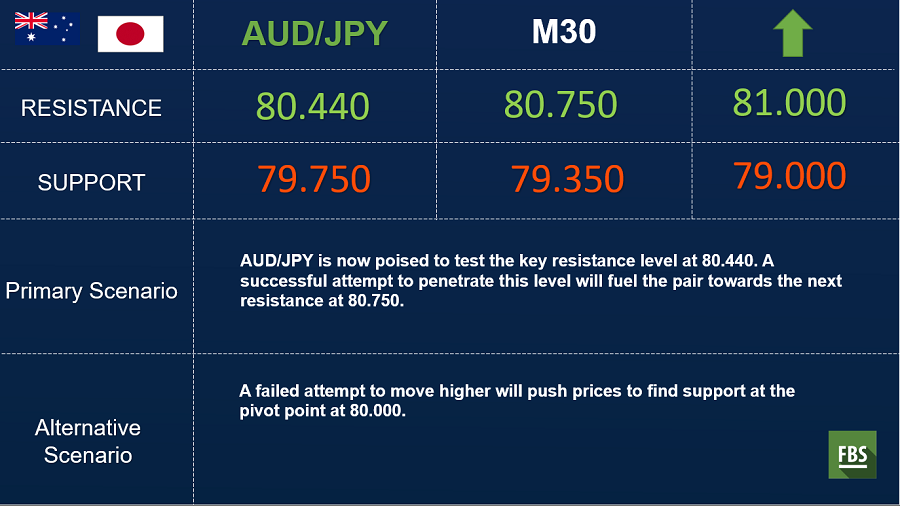

2021-01-27 • Updated

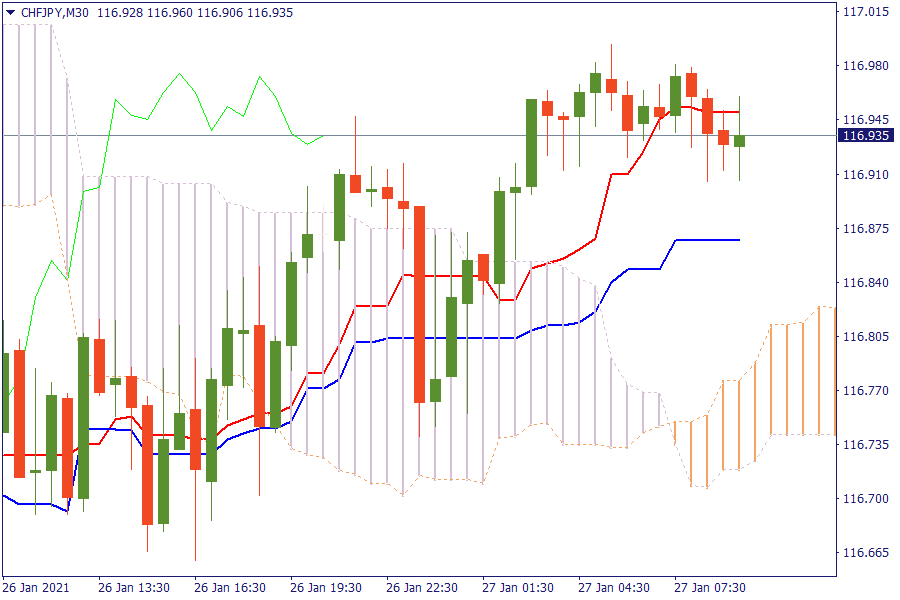

CHF/JPY: The pair is trading above the cloud. An upward pressure would lead the pair to exit further the cloud, confirming a bullish outlook.

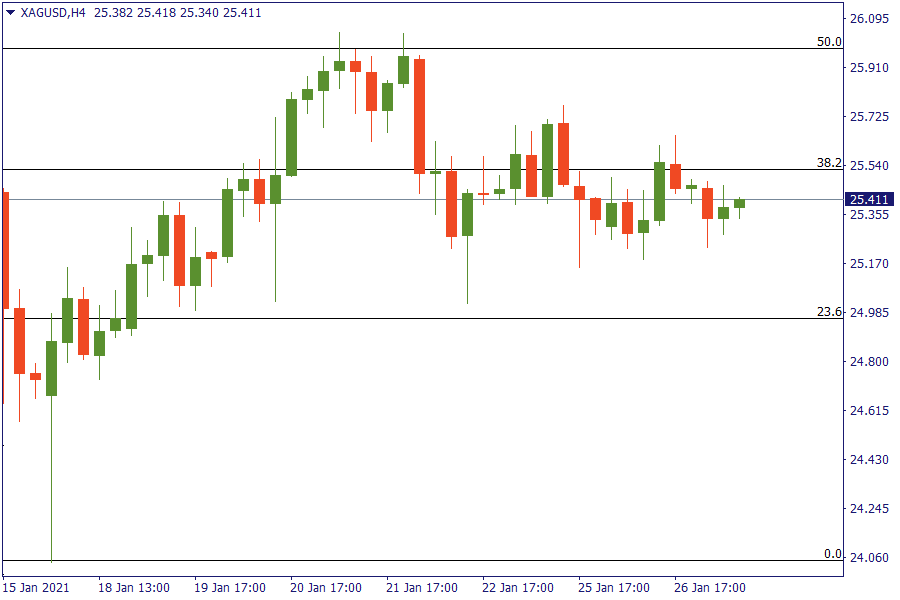

XAG/USD: Silver consolidates between 23.6% and 38.2% retracement areas.

Asian equities traded mixed and attempted to shrug off the weak handover from the US where there was a slight negative bias. The global economy appears to be losing momentum a bit and there is no clear sign yet that COVID-19 infections are slowing even after vaccinations have started in some places. S&P500 futures were mostly flat, capped by caution ahead of the Fed's policy meeting as well as profit-taking on cyclical shares after stellar gains this month. The S&P500 is now trading at 22.7 times its expected earnings, near its September peak of 23.1 times, which was its most inflated level since the dotcom bubble in 2000. Today we expect U.S. Federal Reserve to stick to its dovish tone to help speed the economic recovery when it concludes its two-day policy meeting on Wednesday.

Looking ahead, highlights from macroeconomic calendar include German GFK consumer sentiment, US durables, FOMC rate decision and Fed Chair Powell press conference, NZ trade, ECB's Hakkarainen, Lane, and US. Earnings from Apple, Facebook, Boeing, Tesla, Blackstone.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

Bearish Scenario: Sell below 39600... Anticipated Bullish Scenario: Intraday buys above 39750... Bullish Scenario after Retracement: Intraday buys above 39150

Bearish scenario: Shorts below 18100 with TP1: 17900... Anticipated bullish scenario: Intraday Longs above 18130 with TP...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!