The election factor

Facebook made a pretty significant upswing recently. From $258 per share, it leaped to almost $290 – more than a 10% rise. Nvidia followed the suit with other stocks as well showing that the tech sector of the S&P wants to make the best of the elections. How exactly? In general, Republicans in the US Parliament are more preferred by this sector than the Democrats. At least, the fact that things in the Senate are going to stay pretty much the same as they have been so far means that there will probably be no more restrictions on the tech giants. Logically, they are happy about it – precisely, 10%-happy, like in the case of Facebook. What about the S&P in general?

The cyclical factor

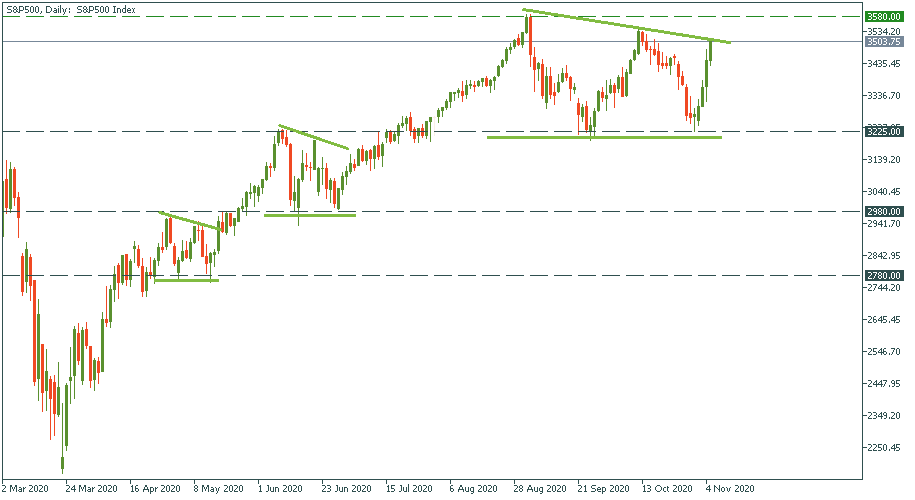

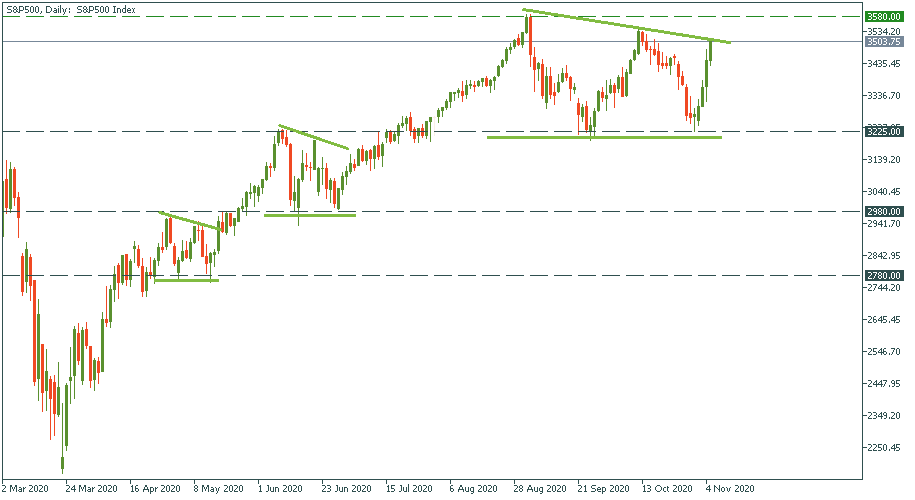

Look at the daily chart of the S&P below.

In March, the S&P oscillated between 2780 and 2980: an upswing, a correction downwards, another weaker upswing, a correction to the same support, then marching upwards.

In June, a similar oscillation happened between 2980 and 3225: reaching a high, going down, making a lower high, going down again to the same bottom, then breaking to the upside again.

In September-October, we same almost the same, just protracted pattern: up, down, up but lower, down again, then breaking upwards once again. The support is now 3225 and the resistance – to yet get broken – is 3580.

What does it suggest? We are likely to witness a strong bullish push beyond 3580 that may well last until the very end of the year. Once it exhausts itself, the support to be watched for the bearish revenge will be in the area of 3580. But now – enjoy the march with bulls.

Don't know how to trade stocks? Here are some simple steps.

- First of all, be sure you’ve downloaded Metatrader 5.FBS allows you to trade stocks only through this software.

- Open the MT5 account in your personal area.

- Reveal all trading instruments by clicking “show all” at the “Market Watch” window.

- Start trading!

LOG IN