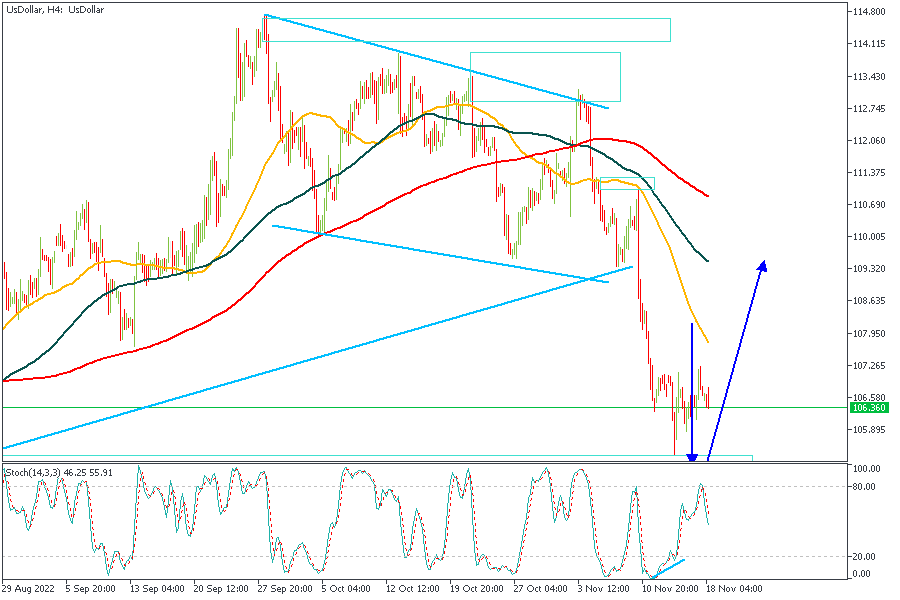

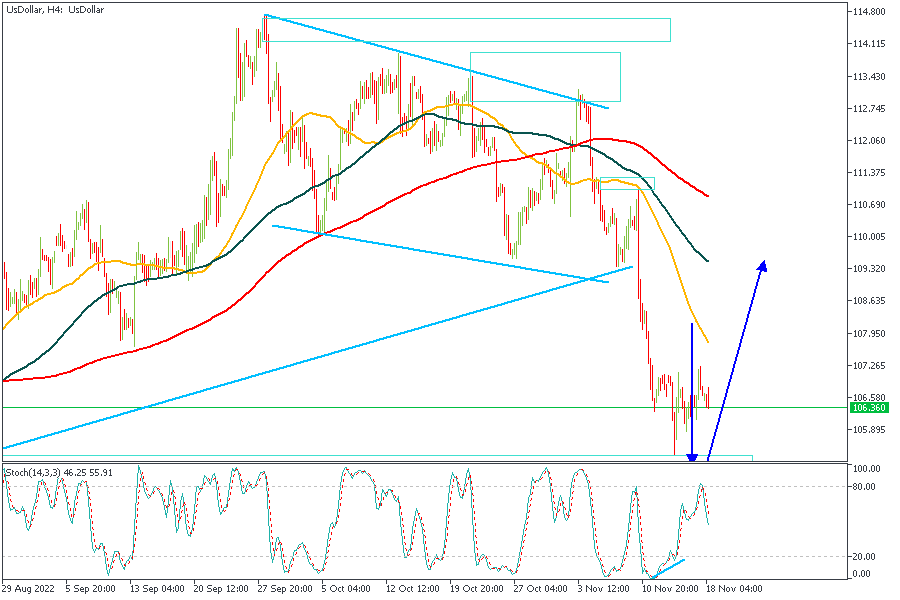

As I earlier indicated in my article this week, I am expecting an upward push from the Dollar as a reaction from the Demand zone I have marked out. The PPI release earlier moved prices a bit, but lacked sufficient momentum to cause a significant break of structure - and thus, no change of trend. Even though my bias remains the same, however, now I expect the move to begin after price must have completed a divergent move inside the demand zone.

The strong numbers from the Retail Sales reports and the Philly Fed Manufacturing index also did its best to kick-start the expected movement. Let's take a look at a few analyses based on this bias.

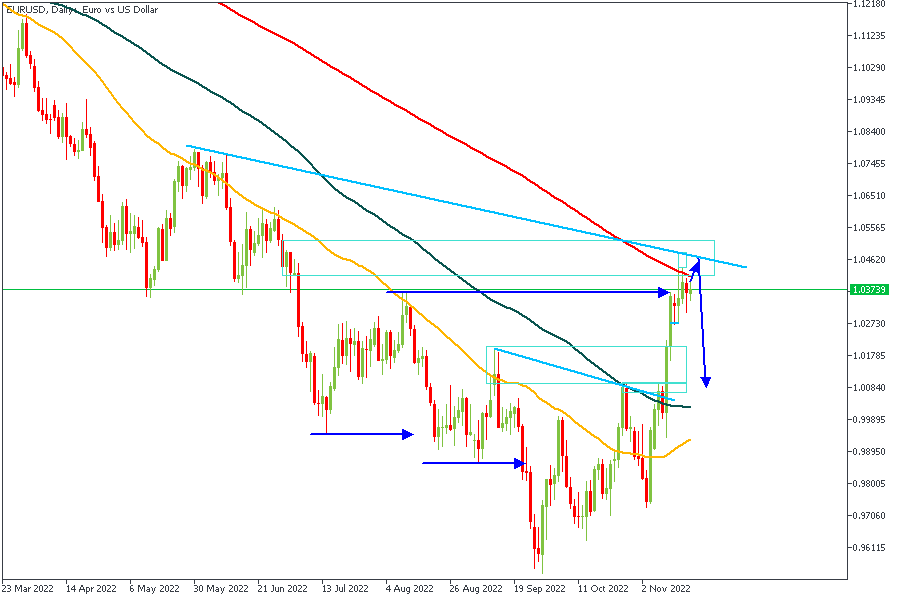

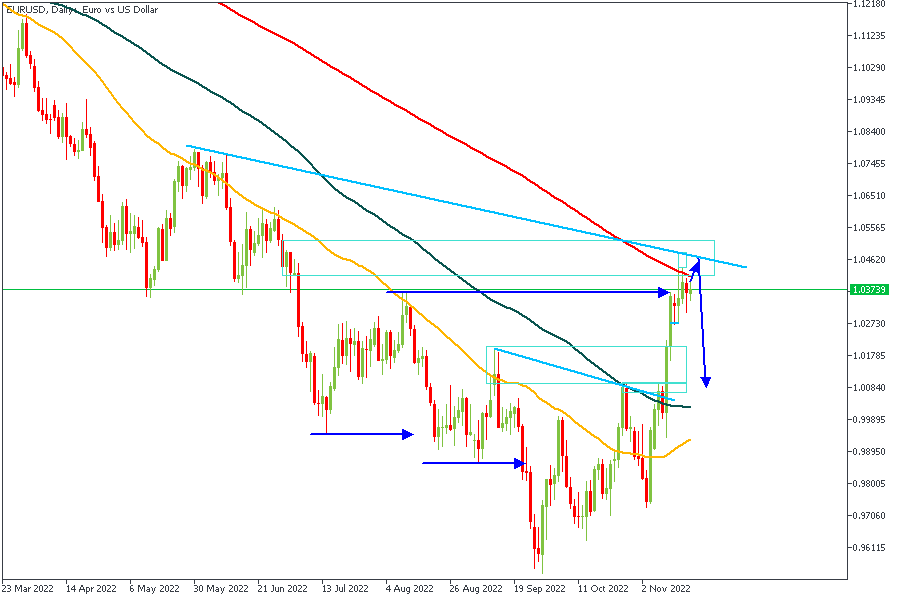

The Hourly timeframe on EURUSD presents a clear selling opportunity from the retest of the Demand zone as a completion of the AMD pattern. The break of structure created by the impulse from the PPI figures yesterday is also a significant indication of a likely persistent bearish impulse.

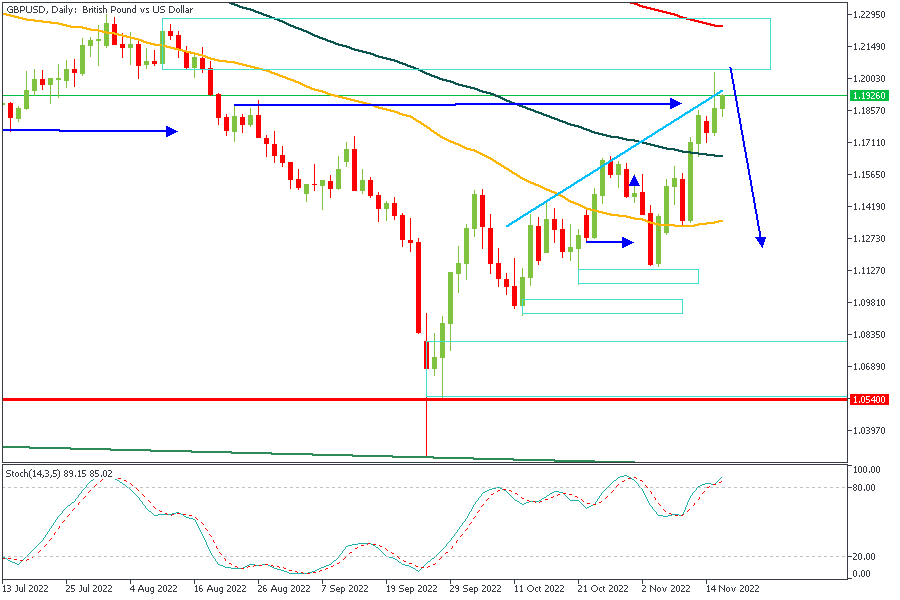

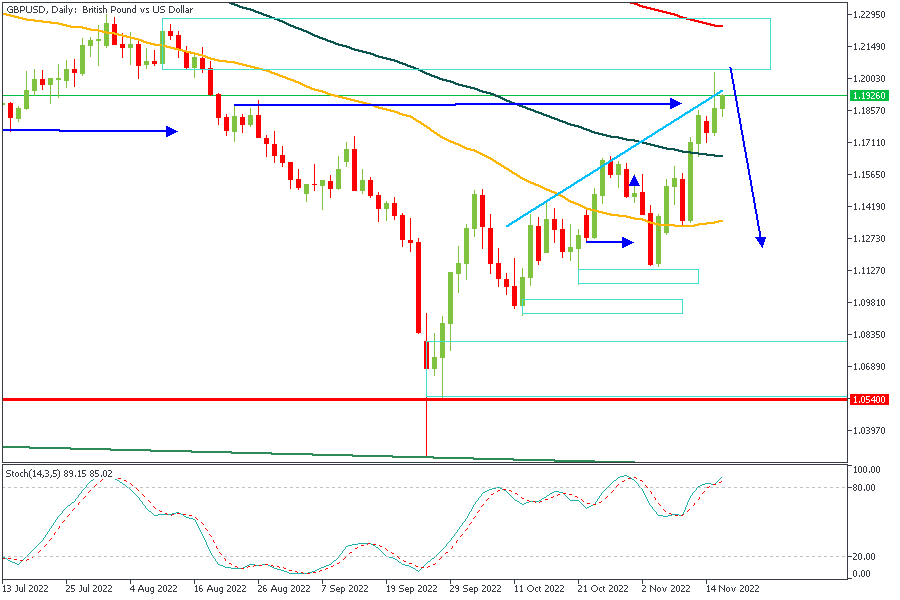

Daily timeframe on GBPUSD places price right next to a major supply zone that's resting within view of the 200-Day Moving Average. We have also seen the liquidity grab from the horizontal blue line; an added confirmation for a rejection and reversal.

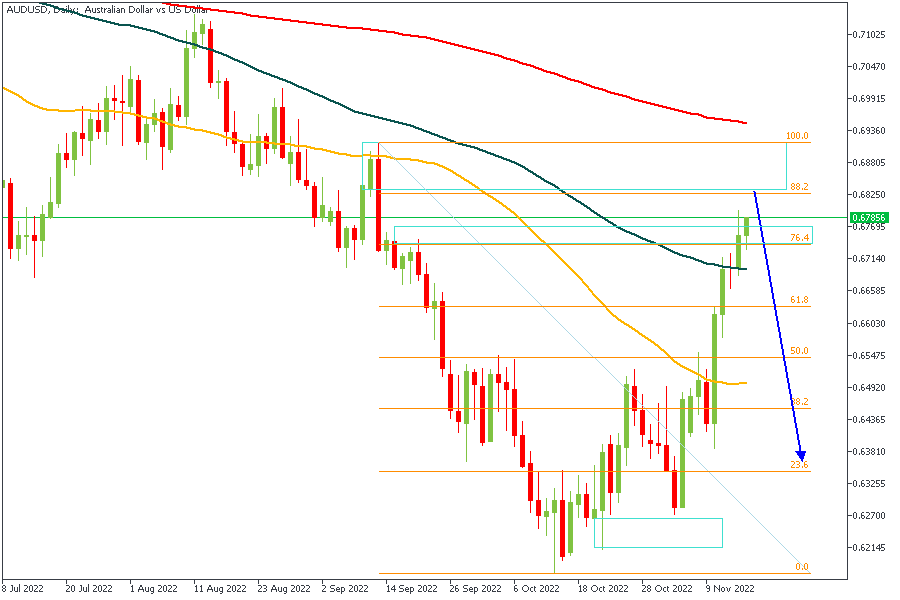

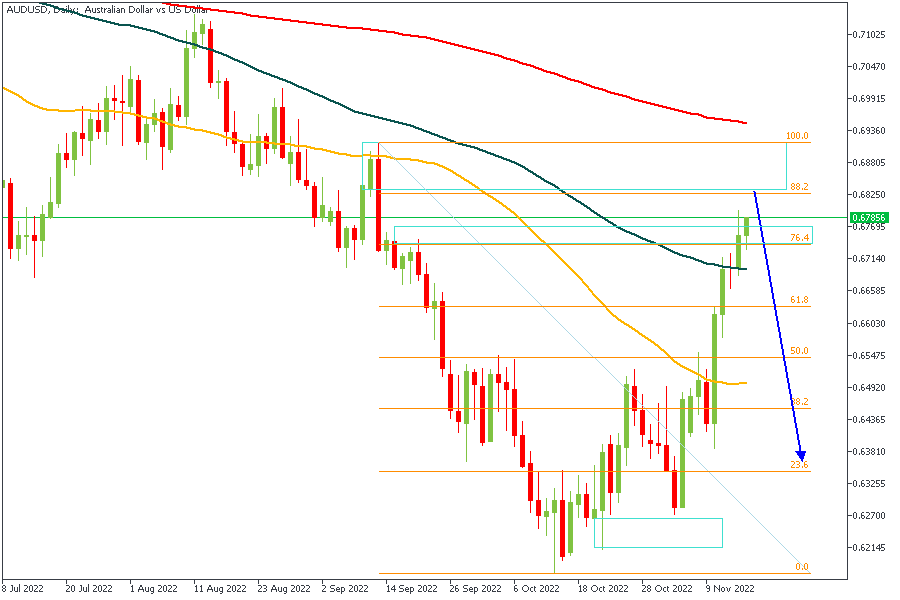

Even though price is currently trading at the 100-Day moving average, the momentum suggests a likely break above the MA in order to create divergence and also give room for price to recover the imbalance between the 76.4% and 88.2% of the Fibonacci retracement. Once this move has been completed, I will be looking for opportunities to short the market.

CONCLUSION

It is important to understand that the trading of CFDs comes at a risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.

Log into your dashboard or create an account here to get started.