GBPJPY was a bit challenging to analyze. The most prominent technical factor that jumped at me as soon as I saw the chart though was the wedge I marked above. Due to the lack of any further reliable confirmations, I will be sitting on my hands until price makes a clear breakout of the wedge with a retest for entry confirmation.

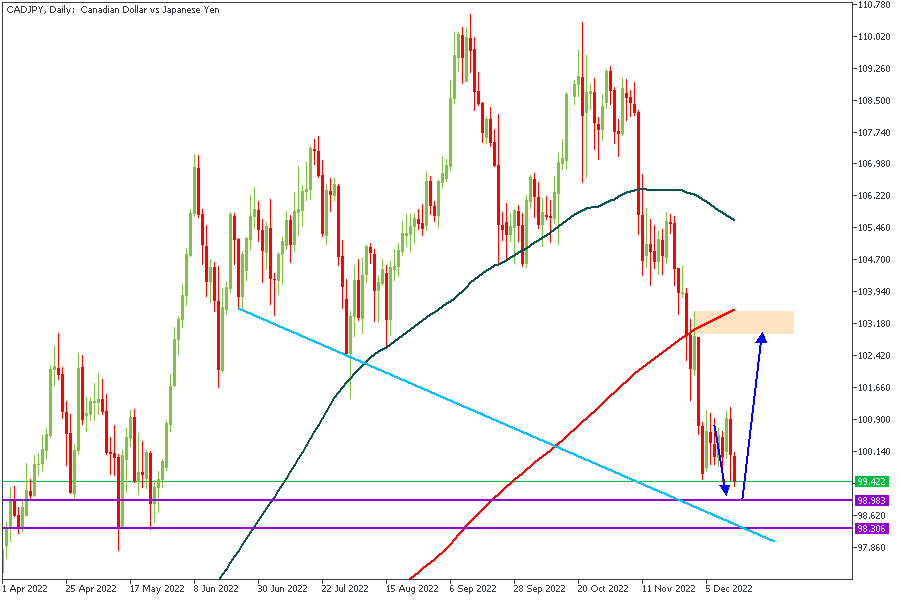

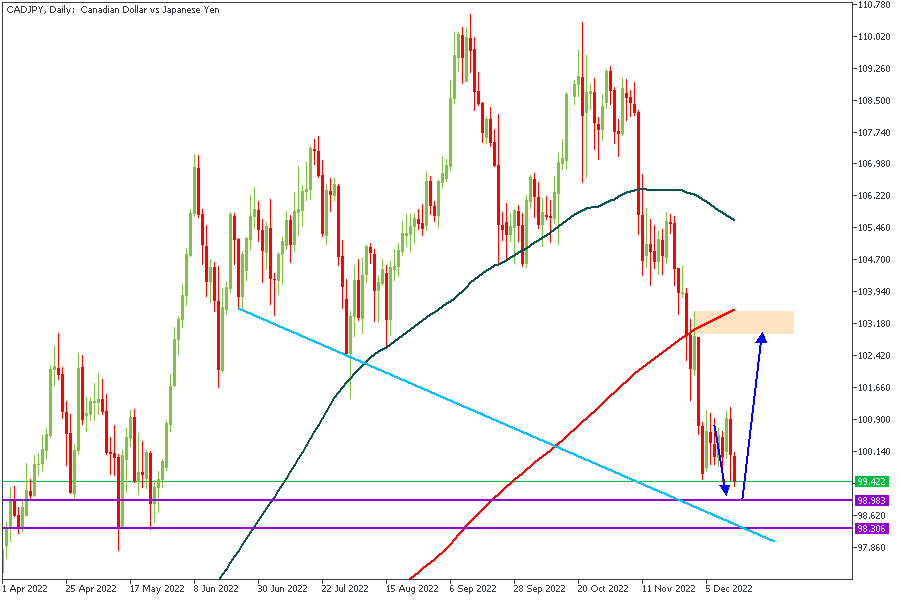

Last week I gave the setup on CADJPY for a bullish reversal from the demand zone after an initial drop deep into the zone. Price seems to have almost completed the downward move into the demand zone, hence, I am expecting a strong bullish reaction from the zone. The trendline support is also a worthwhile confirmation to consider.

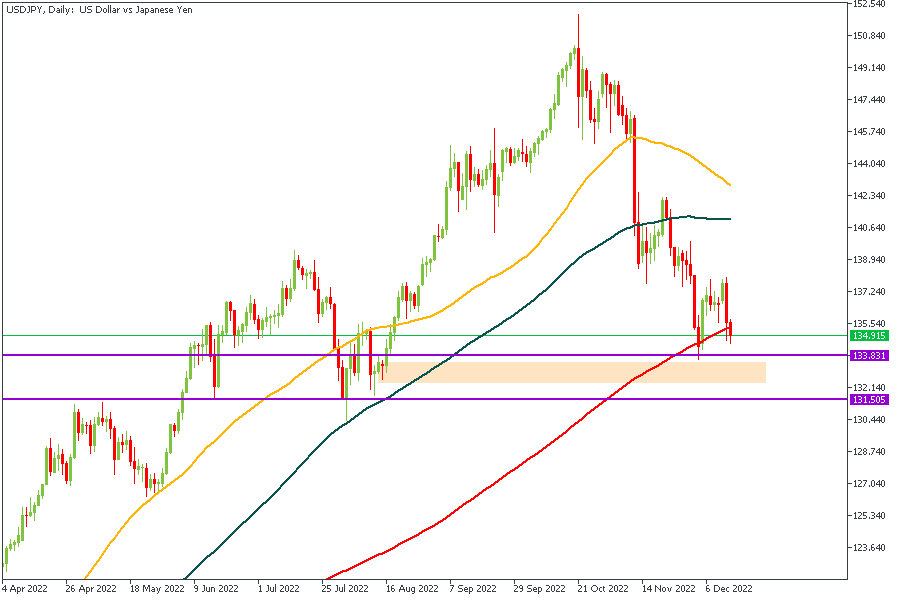

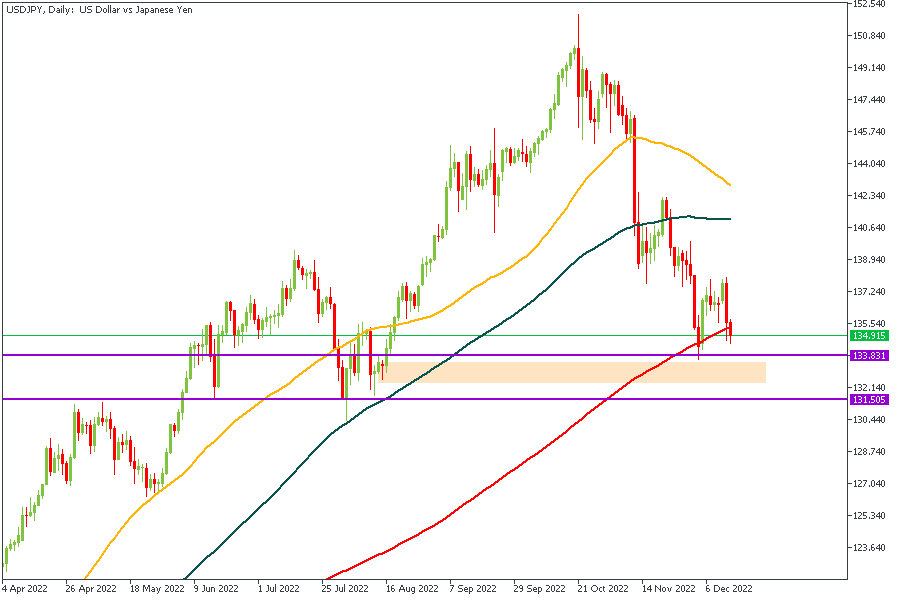

The pivot demand zone on the daily chart of USDJPY is the most feasible point of interest in this scenario. Coupling that with the 200-Day Moving Average lends even more credibility to the demand zone. My expectation from this is that we get to see a bullish reaction from the zone toward the 140 price area.

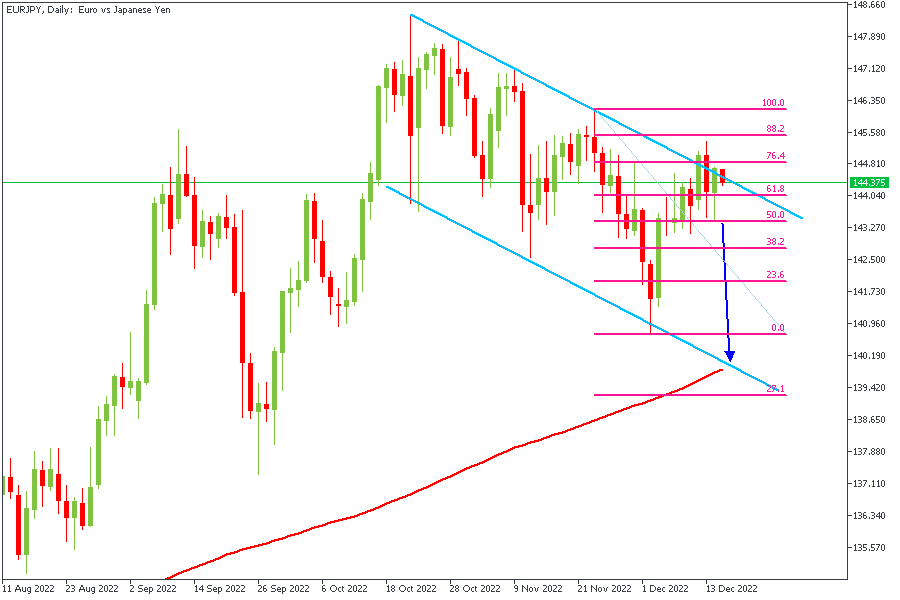

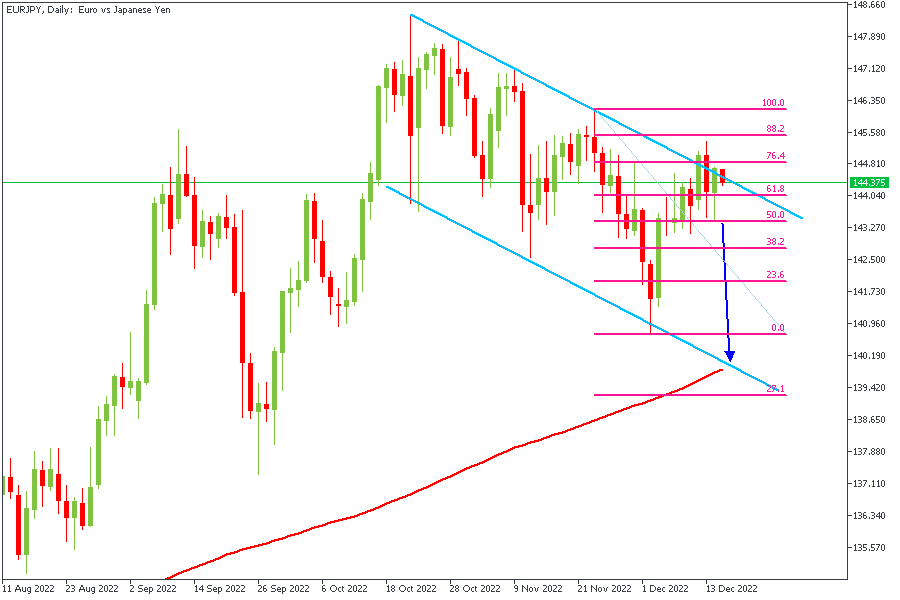

EURJPY is one of the cleanest setups I spotted for Yen crosses. Here, we see price trading structurally within the descending channel toward the 200-Day Moving Average. Price has just recently been rejected from the Fibonacci retracement zone, and considering the trendline resistance that aligns with that zone, we can expect price to turn downwards.

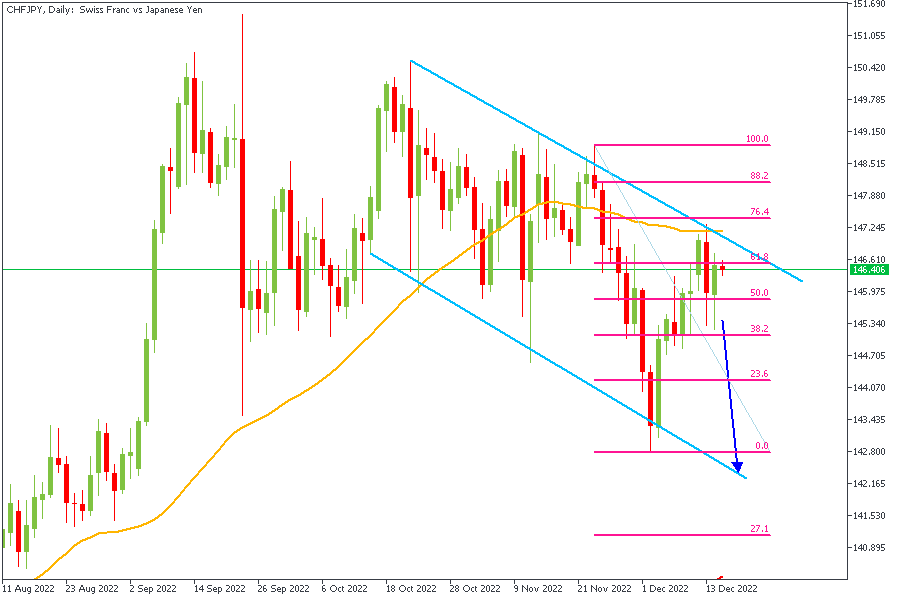

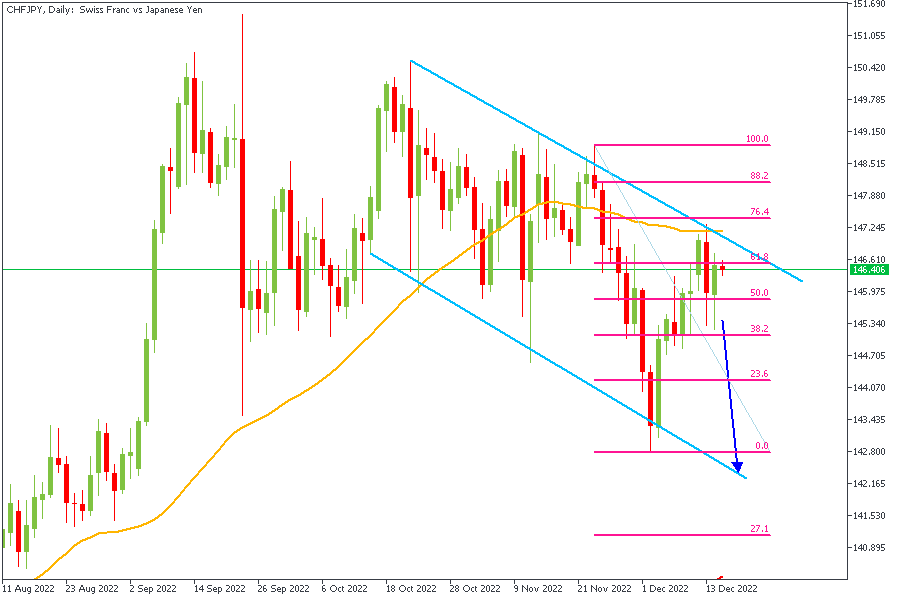

There seems to be another attractive channel scenario on the CHFJPY chart similar to what we saw on the EURJPY chart. The Fibonacci + trendline combo confirmation will most likely push prices even lower, possibly to the 142 price region.

CONCLUSION

It is important to understand that the trading of CFDs comes at risk; if not properly managed, you may lose all of your trading capital. To avoid costly mistakes while you look to trade these opportunities, be sure to do your own due diligence and manage your risk appropriately.

Log into your dashboard or create an account here to get started.