Let's dive into the recent debt ceiling saga in the US and its implications for the economy, deficit, and inflation. The good news is that a new debt deal is on the horizon, saving us from a potential default on June 5. Phew! This deal will impact the economy by providing stability and avoiding a financial catastrophe. It should also help keep the deficit in check, preventing further debt accumulation. As for inflation, the deal aims to address the budget outlook, which could impact inflation rates. However, we'll need to monitor future developments to see how things play out and ensure the US finds solid financial footing. Stay tuned for updates and keep your trading strategies adaptable. Happy trading!

The rejection from the trendline resistance has been clearly established, but we’re yet to see the price trade clear of the pivot zone. Looking at the scenario, my sentiment is bearish based on the following factors;

- Trendline resistance

- Pivot zone acting as supply

- The moving average array is bearish

Analyst’s Expectations:

Direction: Bearish

Target: 103.252

Invalidation: 104.249

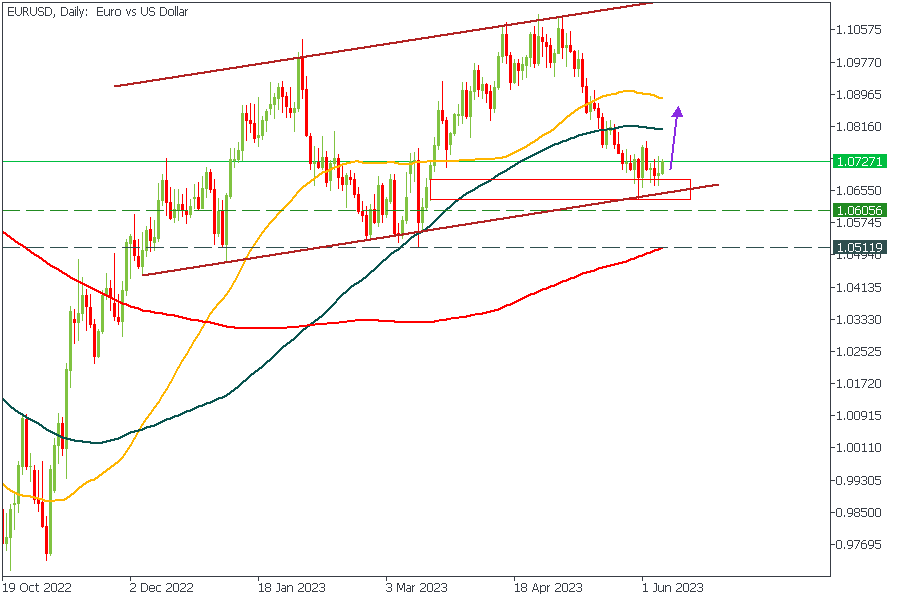

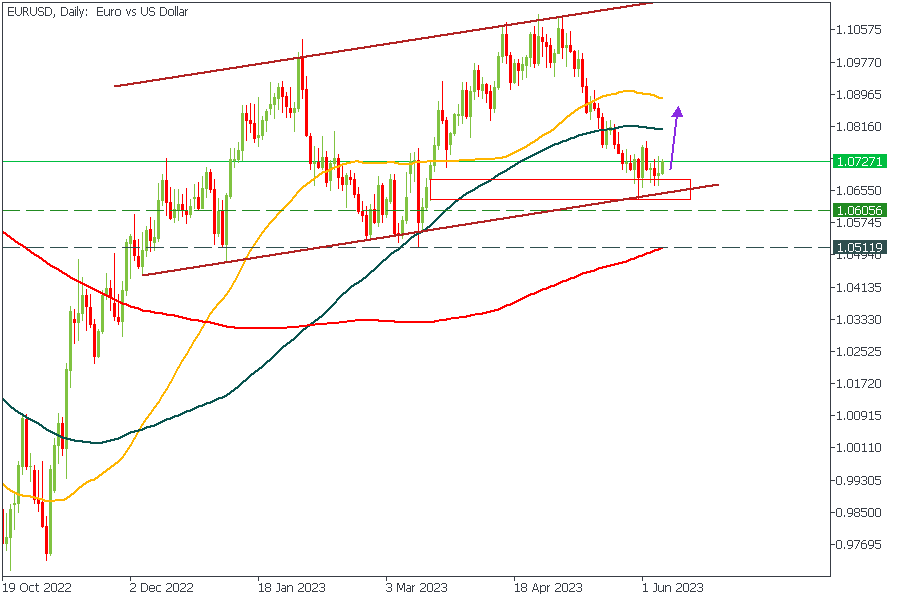

EURUSD - Daily Timeframe

EURUSD has been rejected from the demand zone and the trendline support. Based on the additional confluence from the bullish moving average array, I will uphold my bullish sentiment on EURUSD until the US Dollar reverses its structure. As long as the US Dollar indicates a bearish price action, I will remain bullish on the EURUSD.

Analyst’s Expectations:

Direction: Bullish

Target: 1.08481

Invalidation: 1.06599

AUDUSD - Daily Timeframe

AUDUSD has not yet reached the major resistance zone I have in mind. However, pending the time, I will aim for a clear break of structure (BoS) in the 1Hour timeframe to consolidate my bearish sentiment. The confluences for this trade are;

- Resistance trendline

- Rally-base-drop supply zone

- The bearish array of the moving averages

- 200-Day moving average resistance

Analyst’s Expectations:

Direction: Bearish

Target: 0.65435

Invalidation: 0.68251

GBPUSD - Daily Timeframe

GBPUSD is trading within a rising wedge and has recently seen a clear rejection from the rally-base-rally demand zone and the moving average support. The moving average array also looks clearly bullish, and the 100-Day moving average provided ample support to confirm bullish sentiment.

Analyst’s Expectations:

Direction: Bullish

Target: 1.25740

Invalidation: 1.23679

CONCLUSION

The trading of CFDs comes at a risk. Thus, to succeed, you have to manage risks properly. To avoid costly mistakes while you look to trade these opportunities, be sure to do your due diligence and manage your risk appropriately.

TRY TRADING NOW

You can access more of such trade ideas and prompt market updates on the telegram channel.