What is happening?

During June 2021, the US dollar index has gained 2.3%, which is the biggest run since March 2020. The main reason for the greenback’s growth is FOMC’S June meeting, where US officials signaled that they expect rates to climb already in 2022. Then, Chairman Jerome Powell mentioned that the central bank started to talk about economic stimulus reduction.

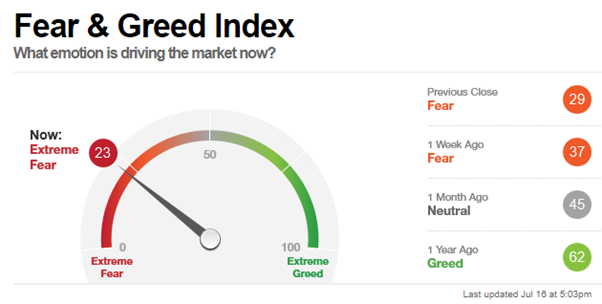

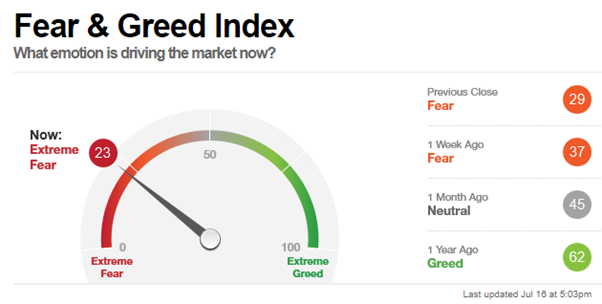

Overbought is the other fact that makes investors to hedge their positions in the stock market. S&P500 gained 101% since March 2020 crush, Nasdaq grew by 125% in the same period. Regular investors are extremely scared and ready to fix their profits since fears about rising inflation could push the central bank to raise the key rate.

Source: https://money.cnn.com/data/fear-and-greed/

At the moment, the US dollar index is showing an opposite correlation with Treasury yields. The same scenario had happened last year but oppositely. Investors betted on the currency falling while yields moved higher in anticipation of economic reopening.

What about Bitcoin?

Risk assets can get under pressure while the US dollar is strengthening. As one of the most speculative assets, Bitcoin boomed against the greenback by 2000% after March 2020 might be in danger. It already dropped by 50% from its record high of about $65.000.

Meanwhile, some analytics relate to the position that Bitcoin might keep its growth after overcoming worries related to the recent China crypto mining ban.

How to trade?

US Dollar Index Daily chart

On the daily chart, reversed “head-and-shoulder” has been formed with an estimated target at the level of 97. As soon as the price breaks the resistance at the level of 93.5, it will head towards the main target. This move allows the US dollar to appreciate by 4.5% against a basket of currencies.

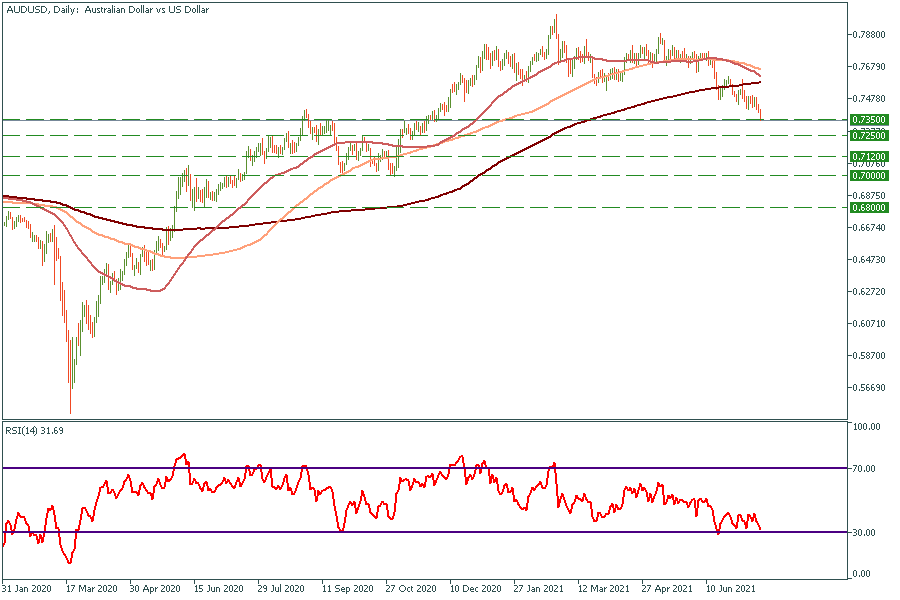

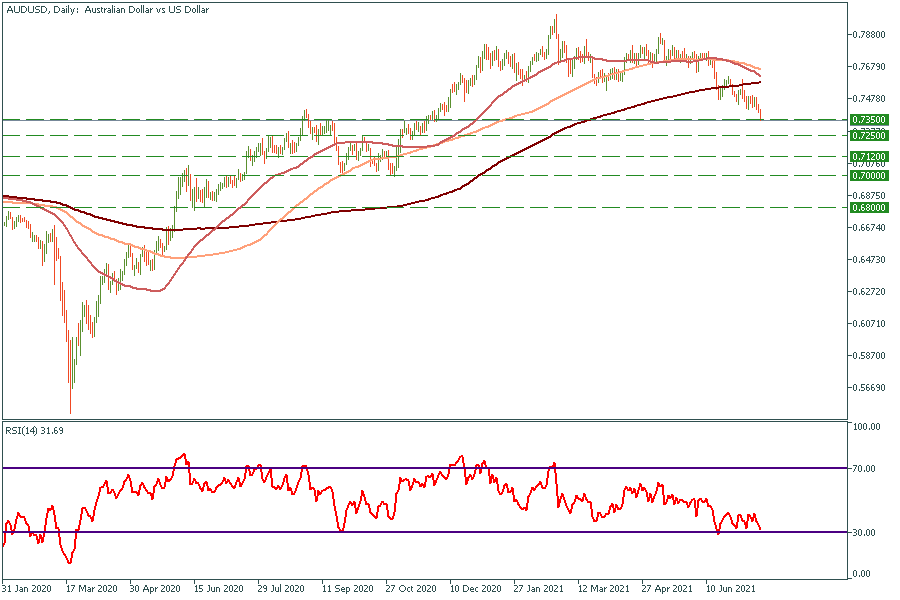

As an example, let’s look at the weekly chart AUDUSD.

US dollar index growth will lead the price to fall with targets at 0.725, 0.712, 0.7, and finally 0.68.