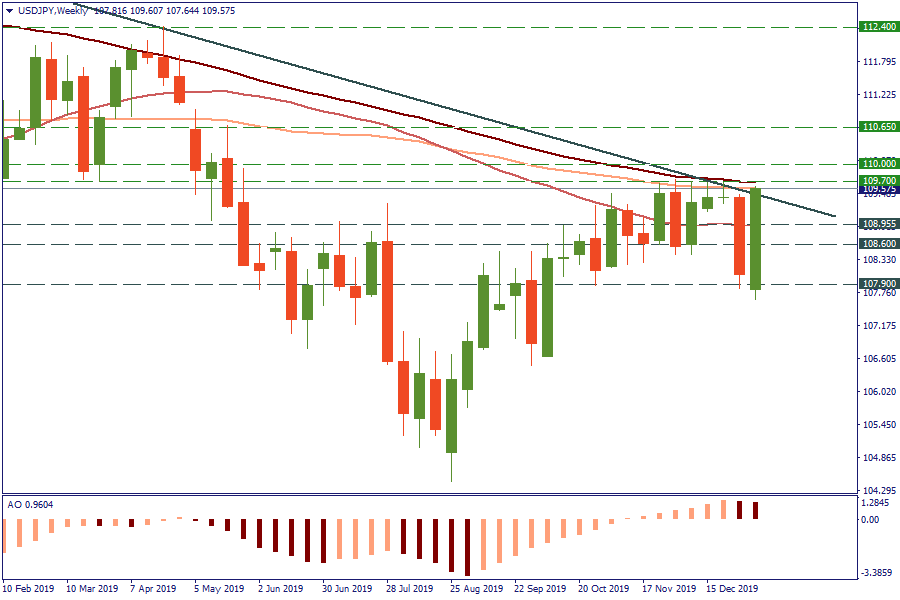

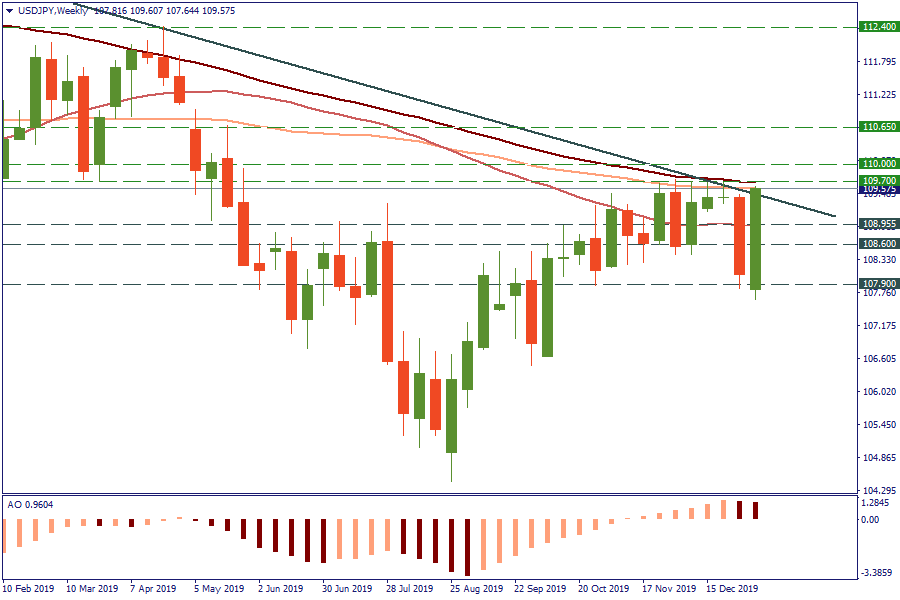

The US dollar had a strong week versus the Japanese yen. USD/JPY opened with a gap down on the W1, but is now trading above the highs of the previous week.

The United States will release Nonfarm Payrolls, Average Hourly Earnings and Unemployment Rate at 15:30 MT time. If the data are better than expected, USD/JPY may test the 110.00 mark. Notice though that on the way there the pair will have to overcome the 100- and 200-week MAs (109.60/70). These lines didn’t let the price higher in November and December and acted as resistance even before that.

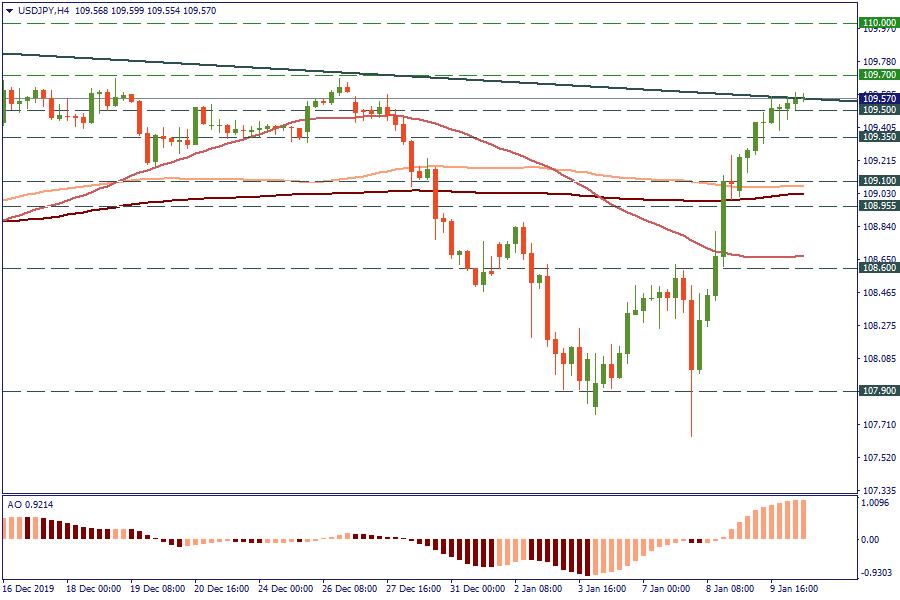

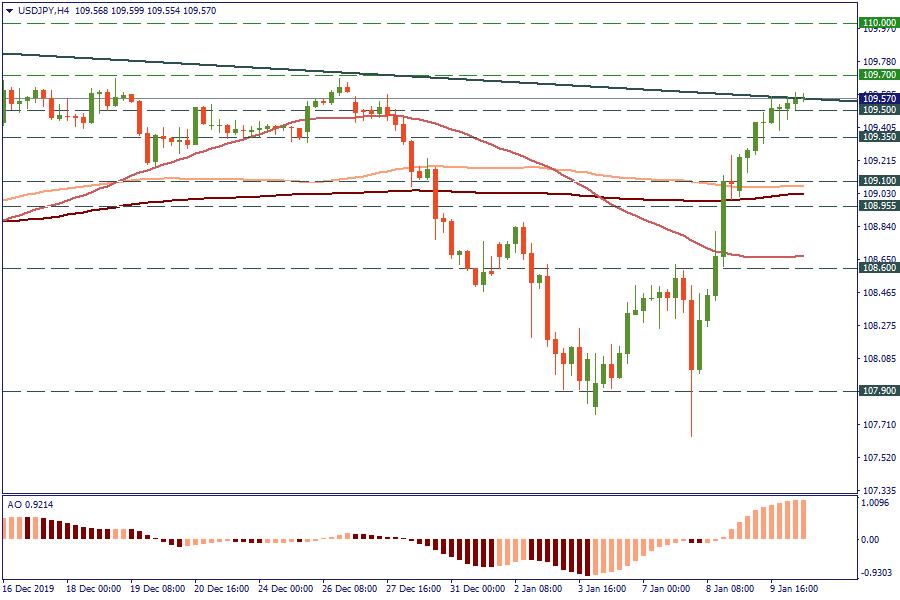

The advance of USD/JPY this week has been quite rapid. Such a move makes the USD overbought in the short-term and creates potential for a correction to the downside. Support lies in the 109.30/20 area and at 108.95 (50-day MA) ahead of 108.60 (200-day MA).

Remember that volatility increases during news releases, so proper risk management is necessary.

Trade ideas

BUY 109.75; TP 110.00; SL 109.60

SELL 109.35; TP 109.05; SL 109.50