What?

Today’s release of employment change raised worries among traders. The employment change for April was down by 30.6 thousand employed people versus the forecast of a rise by 17.5 thousand. The unemployment rate, though, brought optimism with a fall to 5.5%. The forecast was at 5.6%. Despite mixed data, the Australian dollar has shrugged off the negative news and inched higher. However, analysts expect the AUD to turn red pretty soon.

According to ING Bank, the Australian dollar will face pressure in the upcoming days. The main risk will be connected with the economic situation in China.

Why?

Monday’s release showed a slowdown of Chinese industrial production with 9.8% in April. The figures came out lower than the forecast of 10% and the previous month’s outcome of 14.1%. Fixed asset investment also went down to 19.9% versus March’s 25.6%. The most worrying sign of economic instability came from retail sales data. The annual rate of retail sales slowed to 15.8% in April after the growth of 33% last month.

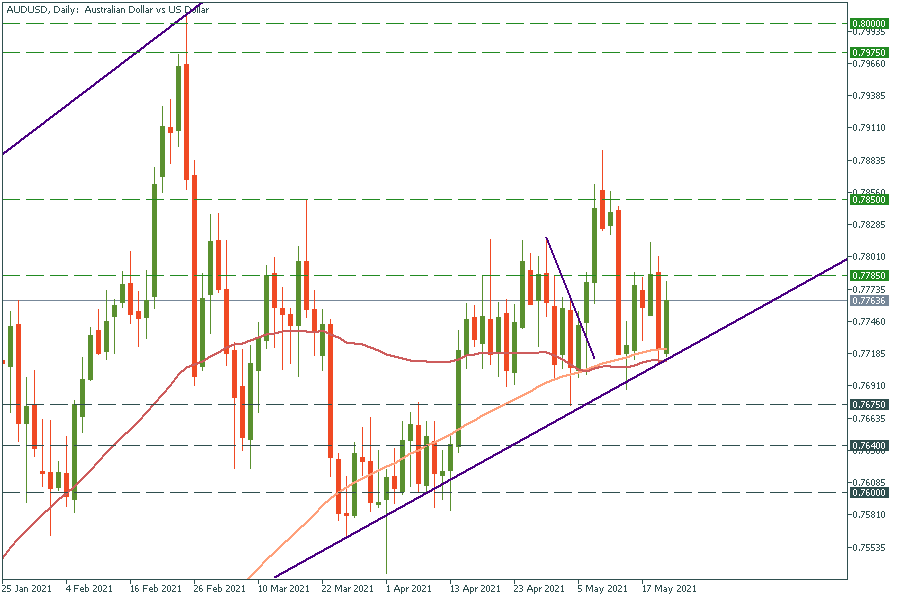

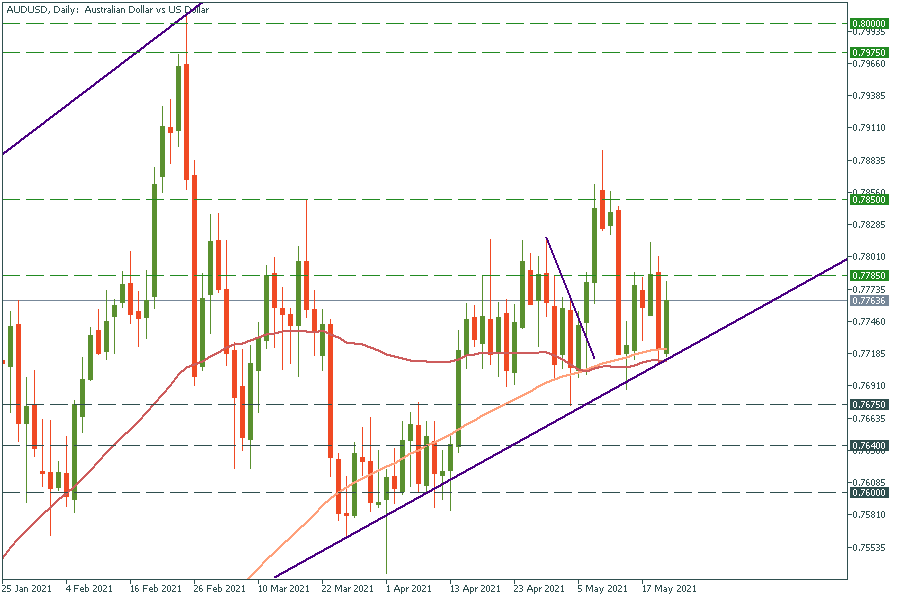

As Chinese economic data plays an important role for the commodity-linked Australian dollar, the slowdown in Chinese economic growth may affect the currency negatively. As a result, the AUD has tested the support of 0.7710 this week.

Another negative factor is connected with a decline in iron ore prices that was provoked by the Chinese government. China vowed to strengthen its management of commodity supply on Wednesday, a move that was aimed at an unreasonable increase in prices.

What is next?

Analysts expect the sell-off in iron ore prices continue next week. If it’s true, this factor will break the recent consolidation of AUD/USD and pull the pair lower. In that case, the first support will be placed at 0.7675. In case of a breakout of this level, the next support will lie at 0.7640. On the upside, pay attention to the resistance of 0.7785.

TRADE NOW