Fundamental

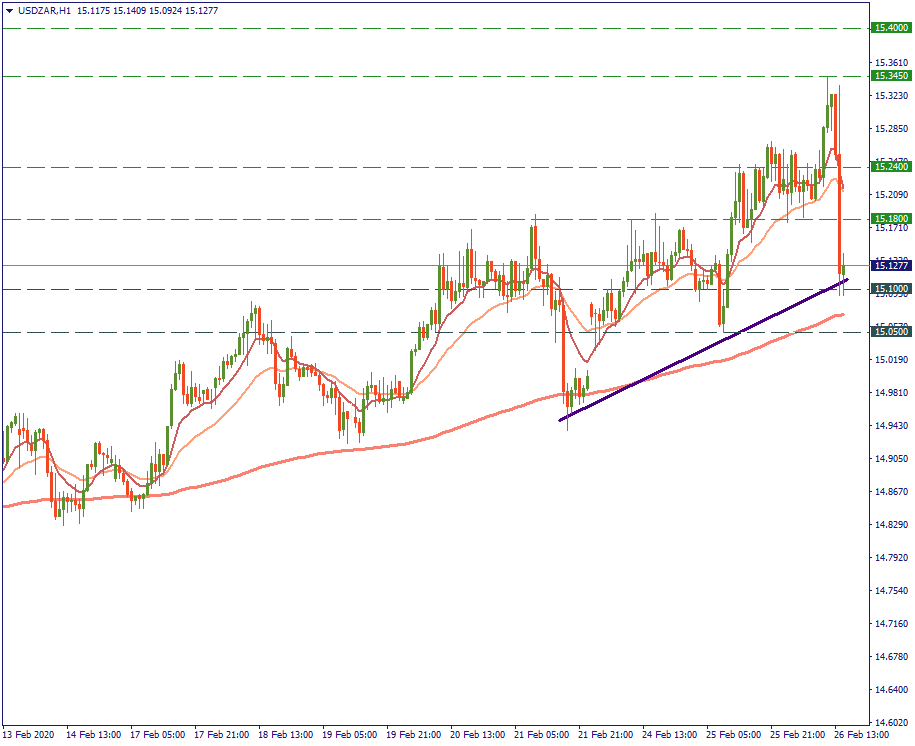

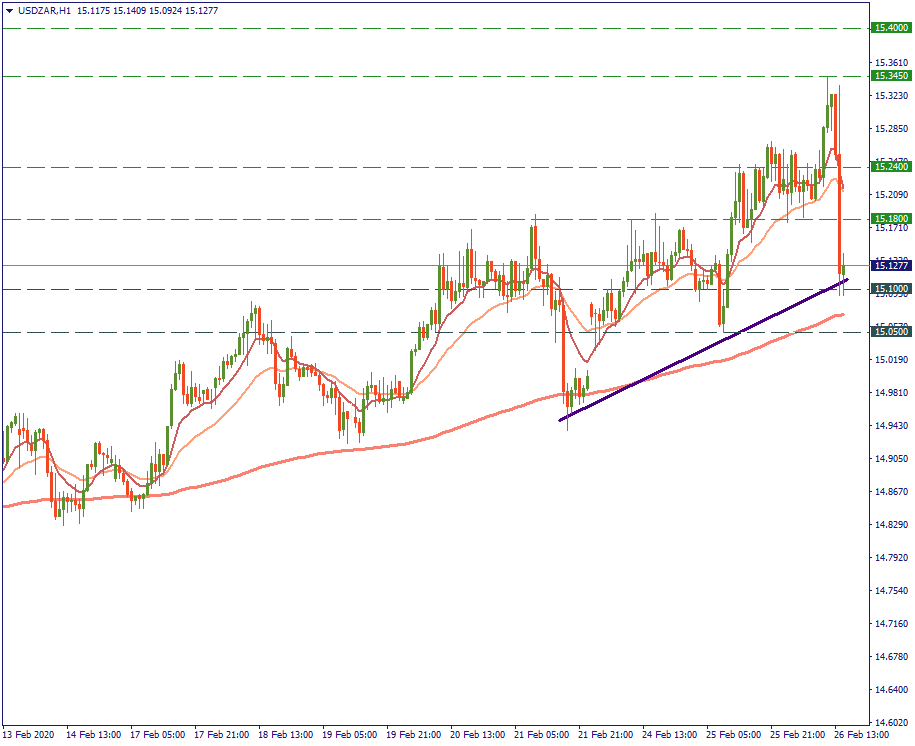

On the H1 chart of USD/ZAR, we can see how this currency pair reacted to the speech of the South African Minister of Finance. Tito Mboweni was speaking for one hour, addressing a wide spectrum of issues in the course of the new budget presentation. The speech was controversial at times but contained certain strong moves and announcements, which – at least, in theory – present significant opportunities for the country to exit the economic stalemate it is in now and move ahead.

The solutions mentioned by Mr. Mboweni ranged from ensuring reliable state-wide electricity supply and increasing taxes on cigars and vapes to establishing a new state reserve fund and dealing with wage disparities. Therefore, from the external observers’ point of view, the speech was full of good indications, without further analysis. Hence, the weakening of the USD against the ZAR is natural in such a promising (for South Africa) atmosphere.

However, the intrigue of the current position of ZAR is whether the market players are convinced enough to start buying ZAR and push it down below the marked trend line. This line is roughly the lower border of the long-term upward trend, during which the South African rand has been consistently losing its positions to the US dollar.

Hence, so far the positive impression of Minister Mboweni’s presentation limited its effect to dragging the ZAR down to the border of this trajectory. But will it be enough to break the strategic direction and change the trend? Probably, to do that, the market needs to time-check the strong announcements Minister Mboweni made and verify them against reality. If there are early signs of positive changes, we are likely to see ZAR gain value against the USD. If not – the trend will go just as it has been for almost the last 10 years.

Technical

Currently, USD/ZAR trades at 15.1277. That is where it tests the local support of 15.1000. In the mid-term, this support has strategic importance: if the currency pair breaks it on the way downwards, that means it will challenge 200-MA roughly at 15.0500. Passing it downwards would signal a strategic trend change – as long as it stays below the 200-MA long enough to break the trend. Otherwise, local resistance levels are at 15.1800 and 15.2400. 15.34500 is where the USD/ZAR started its slide down on the speech of Minister Mboweni. If this level is reached again, that means the positive push for ZAR is undone, and the currency pair would aim at 15.4000 in this scenario.

LOG IN