Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

2021-10-04 • Updated

The stock market keeps falling as investors concern over rising costs, supply-chain issues, and inflationary pressures as they can slow down the economic recovery. Besides, the market sentiment is pressed down by the situation with the indebted property developer China Evergrande Group. Finally, investors await the Federal Reserve to start tapering as soon as next month, which can cause additional sell-off in stocks.

Nevertheless, we see that stock indexes are near the strong support levels. JP 224 has touched the 50-week moving average at 28,200, S&P 500 (US 500) has been moving sideways around the 100-day moving average at 4350, while Hong Kong’s HK 50 has hit the one-year low. Will they reverse up soon?

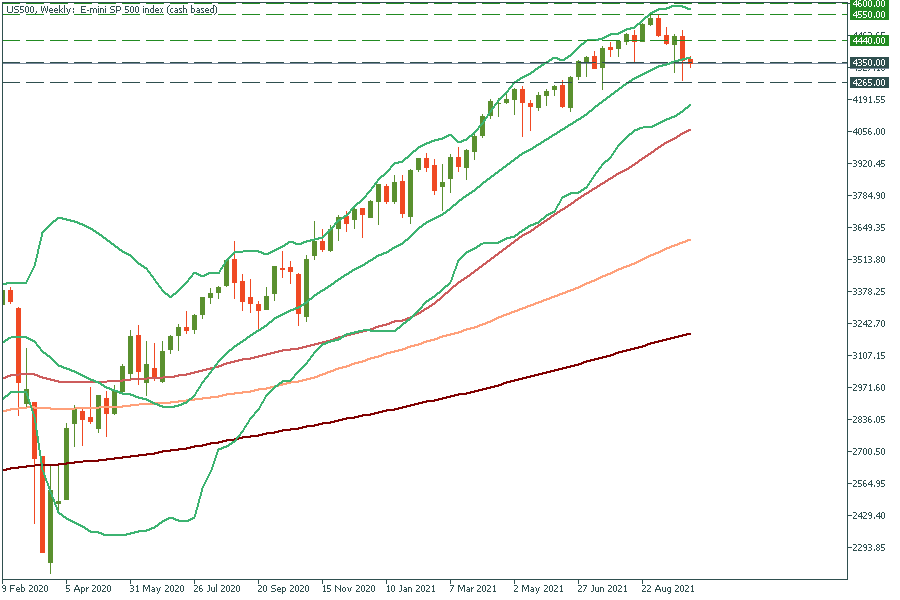

If we open the weekly chart of the S&P 500, we will notice that the stock index has failed to break the midline of Bollinger Bands many times since the Covid-19 outbreak in February-March 2020. Thus, there are more chances that the stock index will reverse up soon and return to the recent highs. For now, we should monitor the price movement and wait for the bullish signals. One of the indicators which can help to find the perfect moment to enter can be MACD. If the MACD indicator surges above the signal line, it can signal the reverse up. Read more about MACD in our article.

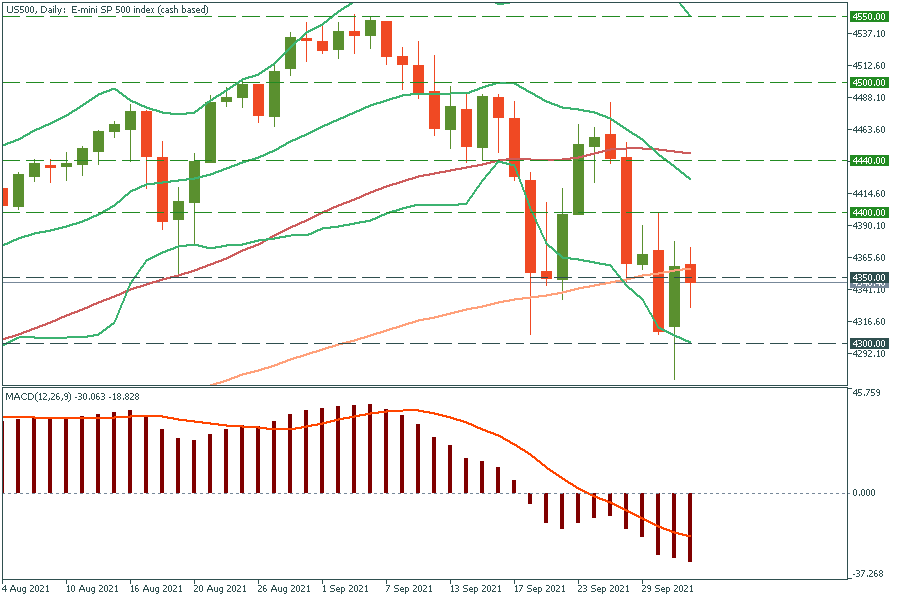

Let’s look at the daily chart of the S&P 500. We can notice a strong resistance level at 4400. If the stock index beaks it, the index may jump to the 50-day moving average of 4440. After breaking through the 50-day MA, the stock index is likely to keep rising to the previous highs of 4600. Support levels are 4350 and 4300.

HK 50 is stuck between 23,860 and 24,550. Since the index has touched the bottom of this channel, it’s likely to jump from it. The first resistance level is 24,250. If HK 50 breaks above it, the index may rally up to the 50-period MA at 24,550.

Bearish Scenario: Sales below 5220... Bullish Scenario: Buys above 5225 (if price fails to break below decisively) ...

During his program on CNBC on February 28, Jim Cramer expressed frustration with the impact of earnings reports on market behavior, noting how they often prompt rash decisions by average investors. He criticized the short-term focus and lack of attention to nuance in news coverage of earnings. Cramer cited examples of Home Depot and Lowe's, highlighting how investors reacted hastily to headline news without considering the broader context provided in earnings calls.

After creating record highs, Wall Street's main indexes opened on Wednesday and began to edge lower, reflecting cautious sentiment among investors. They're eagerly awaiting crucial inflation data that could impact the U.S. Federal Reserve's interest rate decisions. The upcoming release of the personal consumption expenditures (PCE) price index is expected...

Jerome H. Powell, the Federal Reserve chair, stated that the central bank can afford to be patient in deciding when to cut interest rates, citing easing inflation and stable economic growth. Powell emphasized the Fed's independence from political influences, particularly relevant as the election season nears. The Fed had raised interest rates to 5.3 ...

Hello again my friends, it’s time for another episode of “What to Trade,” this time, for the month of April. As usual, I present to you some of my most anticipated trade ideas for the month of April, according to my technical analysis style. I therefore encourage you to do your due diligence, as always, and manage your risks appropriately.

Bearish scenario: Sell below 1.0820 / 1.0841... Bullish scenario: Buy above 1.0827...

FBS maintains a record of your data to run this website. By pressing the “Accept” button, you agree to our Privacy policy.

Your request is accepted.

A manager will call you shortly.

Next callback request for this phone number

will be available in

If you have an urgent issue please contact us via

Live chat

Internal error. Please try again later

Don’t waste your time – keep track of how NFP affects the US dollar and profit!